Why Choosing the Cheapest Agent Could Be Your Most Expensive Mistake

Yes, I’m Aggressive And Your Advocate

Buying or selling a home is likely the biggest financial transaction of your life. Yet, many people make the mistake of comparing agents based on who charges the least.

The truth! Aggressive strategy, creative thinking, and educated guidance are what get you the results you deserve—not simply “I love working with people” and/orb offering you the lowest commission fee. This sounds nice and being personable is great and all, but sellers need more than friendliness—they need market expertise, negotiation skills, and a proven plan to maximize their sale price. Simply saying “I like working with people” doesn’t differentiate you from hundreds of other agents that dont offer real value or strategy in their repoirtoire. And neither is “I’ll charge you the lowest commission.” Yes, low commission fee sounds appealing upfront, but it often signals limited marketing, weak negotiation, and minimal resources to be able to offer that. Sellers who choose based on the lowest fee can end up losing thousands in net proceeds because the home isn’t marketed aggressively or negotiated strategically.

Try not to focus on these weak points becasue these agents:

- focus on personality or price, not results.

- don’t address how the agent will protect the seller’s equity or navigate complex negotiations.

- fail to demonstrate value beyond cost.

When you choose me as your agent, you’re choosing someone who fights for your best interests, brings market expertise, negotiation power, and innovative marketing to the table. That’s how you protect your investment and maximize your outcome.

Let’s Talk … What Does “Cheap” Really Mean?

When you pick an agent solely because they charge the lowest commission, here’s what you might actually be buying:

- Listing Agent – Someone who lists your homes and sits on it but is not actively marketing

- Limited Marketing – Fewer professional photos, no staging, minimal online exposure.

- Weak Negotiation – Lack of experience or confidence to fight for your best price.

- Minimal Guidance – No strategic pricing, no data-driven advice, and little support during inspection or appraisal hurdles.

- Time Delays – Homes that sit longer on the market often sell for less.

Cheap isn’t just about saving a few thousand dollars upfront—it can cost you tens of thousands in lost equity, missed opportunities, and stress.

What Will It Cost You?

- Lower Sale Price – A poorly marketed home can sell for 5–10% less than its potential value.

- Higher Risk – Weak contract terms can expose you to legal or financial pitfalls.

- Lost Leverage – In competitive markets, an agent without aggressive strategy means you lose bidding wars or overpay.

The Smarter Choice

Your home deserves more than a discount approach. It deserves:

- Aggressive Advocacy – Someone who negotiates fiercely for your interests.

- Creative Marketing – Professional photography, staging, and targeted campaigns.

- Educated Strategy – Data-driven pricing and proven negotiation tactics.

This isn’t about paying more—it’s about getting more. The right agent doesn’t cost you money; they make you money.

Ready to protect your biggest investment? Let’s talk strategy.

Home Of The Future

How Connected Is Your Home?

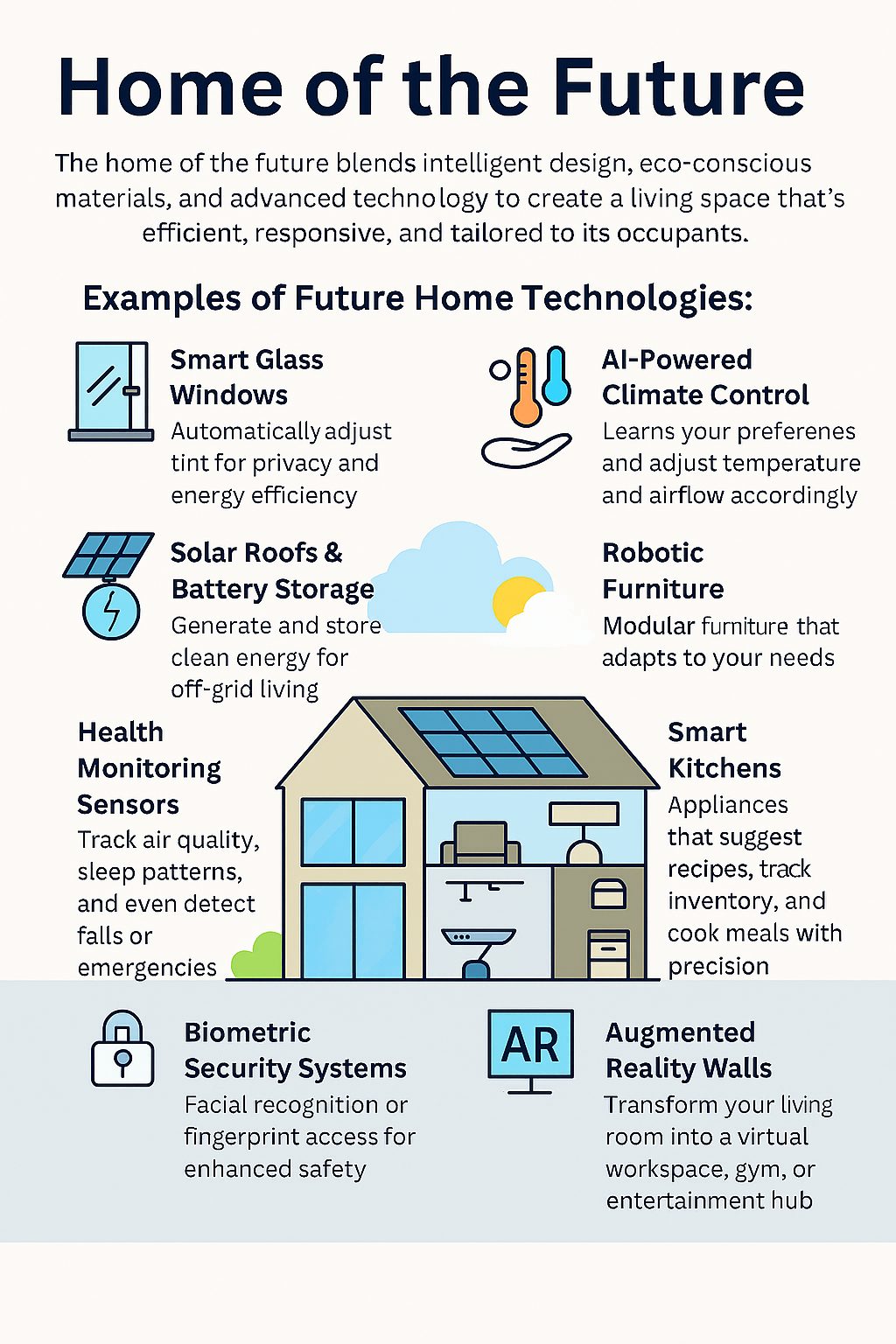

The “Home Of The Future” is a smart, sustainable, and highly personalized living space designed to enhance comfort, efficiency, and well-being; while integrating advanced technologies. The “concept brings a wide range of benefits that align with evolving lifestyles, technological advancements, and environmental priorities. Here are some key advantages:

- Smart automation for lighting, climate control, and security

- Voice/gesture interfaces – seamless interaction

- Energy-efficient systems powered by solar panels and battery storage

- Modular and adaptive design that evolves with the occupants’ needs

- Eco-friendly materials and water-saving features

- AI-driven personalization learning routines and preferences

Areas Of Benefits As Observed Today:

- Smart Glass Windows – Automatically adjust tint for privacy and energy efficiency.

- AI-Powered Climate Control – Learns preferences and adjusts temperature and airflow accordingly.

- Voice & Gesture Interfaces – Control lights, appliances, and entertainment systems with simple commands or hand movements.

- Solar Roofs & Battery Storage – Generate and store clean energy for off-grid living.

- Water Recycling Systems – Reuse greywater for irrigation and reduce waste.

- Robotic Furniture – Modular furniture adapting to your needs, like beds folding into walls, tables automatically expand.

- Health Monitoring Sensors – Track air quality, sleep patterns, detect falls or emergencies.

- Smart Kitchens – Appliances that suggest recipes, track inventory, cooks meals w/ precision.

- Biometric Security Systems – Facial recognition or fingerprint access for enhanced safety.

- Augmented Reality Walls – Living room transforming into a virtual workspace, gym, or entertainment hub.

Examples Include

-

1. Smart Technology Integration

- AI-Powered Automation: Homes will learn your habits and automate tasks like adjusting lighting, temperature, and even brewing coffee at your preferred time.

- Voice & App Control: Seamless control of appliances, lighting, and security systems via voice commands or mobile apps.

- Augmented Reality (AR): Interactive features like AR cooking tutorials or smart mirrors displaying your schedule. [futuristspeaker.com]

2. Energy Efficiency & Sustainability

- Solar Power & Renewable Energy: Integration of solar panels and energy-efficient systems to reduce carbon footprints.

- Eco-Friendly Materials: Use of sustainable materials like bamboo, cork, and reclaimed wood.

- Smart Lighting: Adaptive lighting systems that adjust based on mood or time of day, enhancing comfort and reducing energy use. [infrastructurist.com], [primo.house]

3. Health & Comfort

- Air Quality Monitoring: Sensors to detect allergens, pollutants, and other health hazards.

- Wellness Features: In-home gyms, meditation rooms, and spa-like amenities to promote physical and mental well-being.

- Soundproofing & Natural Light: Enhanced comfort through better insulation and daylight optimization. [alfordhomes.com]

4. Security Enhancements

- Biometric Access: Facial recognition and fingerprint scanning for secure entry.

- Mobile Robot Guards: Autonomous robots patrolling homes, detecting intrusions, and monitoring environmental changes. [thezebra.com]

5. Flexible Living Spaces

- Modular Design: Rooms that can easily transform into offices, guest rooms, or play areas.

- Adaptability: Homes designed to accommodate changing family sizes and lifestyles. [alfordhomes.com]

6. Connected Ecosystems

- IoT Integration: Appliances and systems communicating with each other for optimized performance.

- Remote Access: Control and monitor your home from anywhere in the world. [alfordhomes.com]

If you remotely even considering Renovating Your Older Homes with Future-Forward Features, here are some examples to consider:

- Smart Climate Control in Historic Homes

- Ductless Mini-Split HVAC Systems: These systems offer modern climate control without the need for extensive ductwork, making them ideal for older homes with limited space or historical preservation restrictions. They can be controlled remotely and programmed for energy efficiency. [bobvila.com]

- Energy-Efficient Windows with Vintage Aesthetics

- Replace outdated windows with energy-efficient models that mimic the original design. This preserves the home’s look while improving insulation and reducing energy costs. [realsimple.com]

- Smart Lighting & Automation

- Install smart lighting systems that adjust based on time of day or occupancy. Use vintage-style fixtures retrofitted with smart bulbs to maintain the aesthetic while adding modern convenience.

- Preserving Original Features with Modern Enhancements

- Restore original woodwork, crown molding, and built-ins, then integrate hidden smart speakers, automated blinds, or smart thermostats to blend old-world charm with new-world tech. [realsimple.com], [re-thinkin…future.com]

- Home Security with Discreet Tech

- Add smart locks, video doorbells, and motion sensors that blend into the home’s design. These can be installed without altering the structure or aesthetics significantly.

- Sustainable Retrofitting

- Use eco-friendly insulation, solar panels, and energy-efficient appliances to reduce the carbon footprint. These upgrades can be done while respecting the home’s original materials and layout. [birkesbuilders.com]

- Smart Kitchens in Vintage Spaces

- Incorporate smart appliances like voice-controlled ovens, refrigerators with inventory tracking, and touchless faucets into a kitchen that retains its vintage cabinetry and tilework.

- Adaptive Reuse of Spaces

- Convert unused attics or basements into tech-enabled home offices or media rooms with smart lighting, soundproofing, and ergonomic design—without compromising the home’s historical layout. [birkesbuilders.com]

And, if you are planning on Living in the rennovated “home of the future,” some Key Benefits Of That Rennovation include:

- Increased Property Value

- Achieving Customization to tailor the home to your lifestyle and preferences

- Improved Energy Efficiency with better insulation, energy efficient lighting and windows, reduced utility bills, increased comfort, and long term savings

- Enhanced Functionality and Space Usability

- Improving Health & Safety for better living environment, ventilation, air quality, and overall health

- Curb Appeal to help make your home more attractive and inviting, which is especially beneficial for resale

- Tax Benefits especially from energy-efficient upgrades may qualify for tax credits or rebates

- Long-Term Savings from investment in quality materials and systems while reducing maintenance costs and extending the life of the home’s components

In essence, future homes will be more connected, responsive, and environmentally conscious—blending technology with thoughtful design to create healthier, more intuitive living environments.

Get connected!

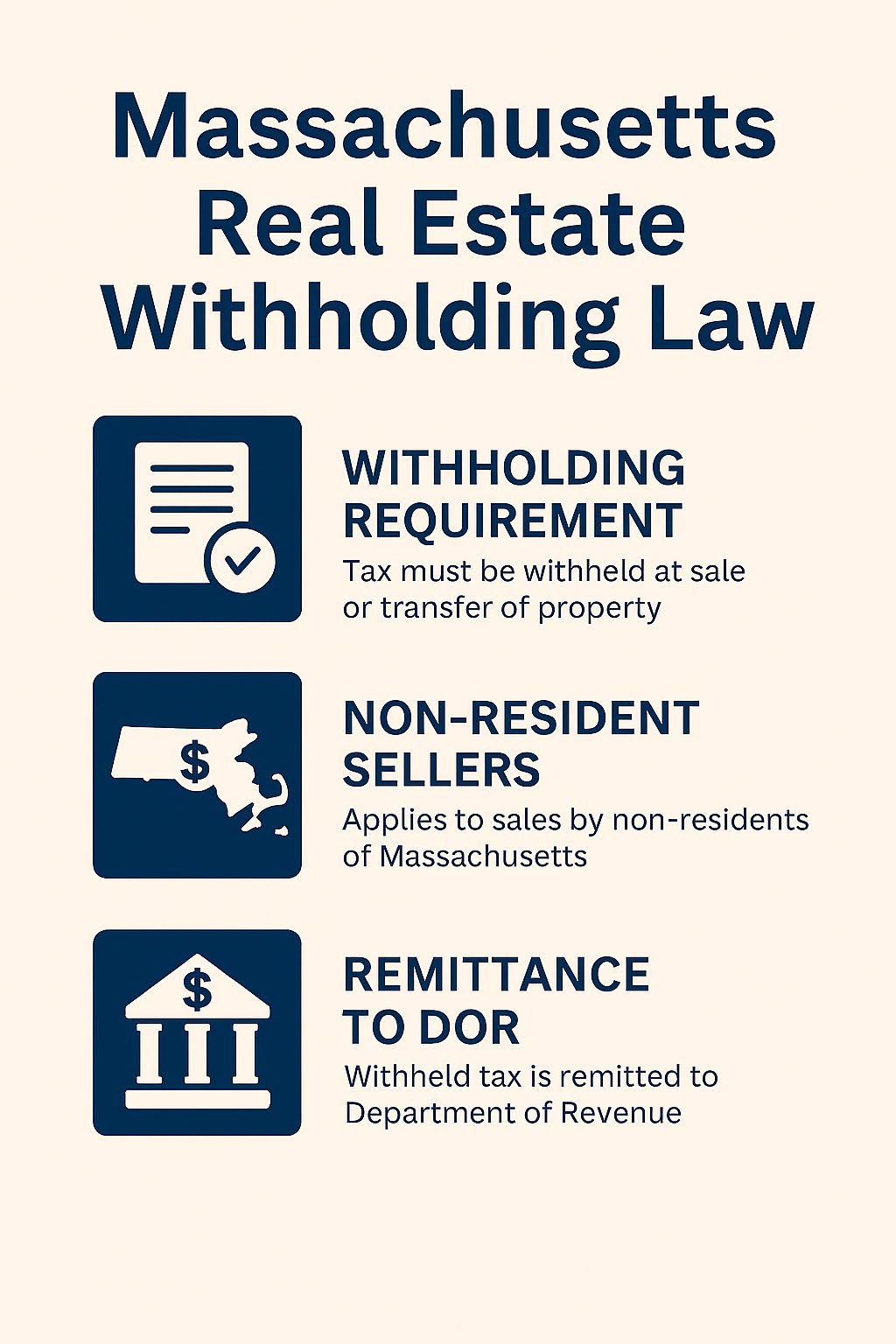

Massachusetts Real Estate Withholding Law – Effective November 1, 2025

The upcoming new Massachusetts regulation 830 CMR 62B.2.4 issued by the Massachusetts Department of Revenue (DOR), under M.G.L. c. 62B, § 2, establishes withholding requirements on the sale or transfer of Massachusetts real estate. Basically, the law authorizes the DOR to require withholding of taxes on certain payments, including real estate sales. It targets nonresident Sellers (individuals or entities) without a continuing Massachusetts presence, selling Massachusetts real estate where the gross sales price is $1,000,000 or more. [mass.gov]

The expected effective date applies to real estate closings on or after November 1, 2025.

🔹 Key Requirements

- Withholding At Closing Agent Responsibilities:

- Typically Settlement agents – closing attorney, title company, or escrow agent.

- Must withhold a portion of the sale proceeds (typically 4-5% or more of the gross sale proceeds) and remit it to the MA DOR within 10 days of closing.

- Must file a Form NRW (Nonresident Real Estate Withholding Return), even if no tax is withheld. [stewart.com]

- Electronic Filing: All filings and payments must be submitted via https://www.mass.gov/orgs/massachusetts-department-of-revenue.

- Transferor (Seller) Responsibilities:

- Sellers must complete a Transferor’s Certification form to document residency or exemption status.

- This form documents the seller’s capital gain and exemption status, if applicable. [mass.gov]

- Sellers must complete a Transferor’s Certification form to document residency or exemption status.

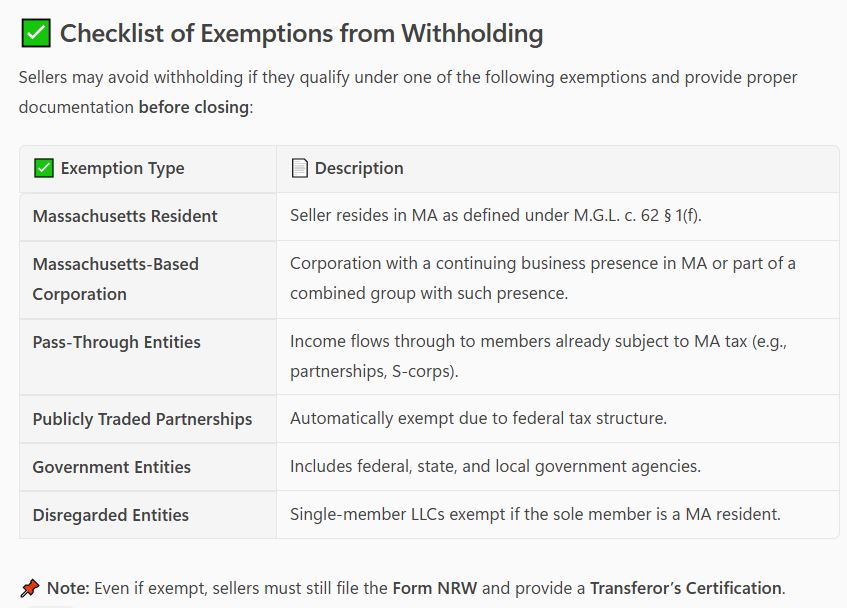

🔹 Exemptions & Exceptions

- Certain sellers may qualify for exemptions from withholding, if they are

- Massachusetts residents (Defined under M.G.L. c. 62 § 1(f) and they must certify residency status on the Transferor’s Certification.)

- Certain types of MA based entities (Corporations with a continuing business presence in the Commonwealth. And, members of a combined group where at least one member has a Massachusetts presence.)

- Pass-Through Entities (Entities whose income flows through to members already subject to MA tax. And includes partnerships and S-corps filing Massachusetts tax returns.)

- Publicly traded partnerships (Automatically exempt due to their tax structure and reporting obligations.)

- Government entities (Includes the Federal government, Massachusetts government, and political subdivisions or agencies.)

- Disregarded entities (e.g., single-member LLCs) whose sole member is a Massachusetts resident. [mass.gov], [virtualund…writer.com], [riw.com] And if the exemption is based on the owner’s tax status, not the entity itself.

⚠️IMPORTANT NOTE:

- Even if exempt, the Form NRW (Nonresident Real Estate Withholding) must still be filed by the withholding agent. [stewart.com].

- Sellers should consult a tax advisor well before closing to ensure compliance.

- Failure to comply may result in penalties and interest.

🔹 Withholding Rates

- Standard Rate: 4% of the gross sales price

- Alternative Rate: 5% of the estimated net gain

- Surtax: Additional 4% may apply if the gain exceeds the surtax threshold. [dlgclosing.com]

🔹 Special Cases Covered

- Installment sales

- Like-kind exchanges

- Corporate entities

- Estimated adjusted basis calculations

🔹 Special Cases Covered explained:

- Installment Sales

- If a real estate sale qualifies as an installment sale under Massachusetts law (M.G.L. c. 62, § 63), the entire gross sales price is still considered for withholding purposes.

- However, the withholding amount may be limited to the cash received at closing, not the full contract price.

- The Transferor’s Certification must disclose the installment nature of the transaction and the amount of cash received.

- Like-Kind Exchanges (IRC § 1031)

- If the transaction qualifies as a like-kind exchange under IRC § 1031, and the gain is deferred, withholding is not required on the deferred portion.

- The Transferor must certify:

- The amount of gain deferred.

- That they consent to Massachusetts jurisdiction for future tax collection when the gain is eventually recognized.

- If any gain is recognized (e.g., due to boot or partial cash received), withholding is required on that recognized portion.

- Corporate Entities

- Corporations with a continuing Massachusetts business presence may be exempt from withholding.

- To qualify:

- The corporation must have filed a Massachusetts tax return in the prior year.

- It must maintain a place of business in Massachusetts.

- It must not be selling all or substantially all of its Massachusetts assets (which would trigger other tax obligations under M.G.L. c. 62C, § 51).

- Estimated Adjusted Basis Calculations

- This is used when a seller elects the alternative withholding method based on estimated net gain rather than gross sales price.

- Estimated Adjusted Basis includes:

- The original purchase price (or fair market value at inheritance).

- Plus major improvements (if known).

- The Estimated Net Gain = Gross Sales Price − Estimated Adjusted Basis − Settlement Expenses.

- The seller must provide this calculation on the Transferor’s Certification to use the alternative method.

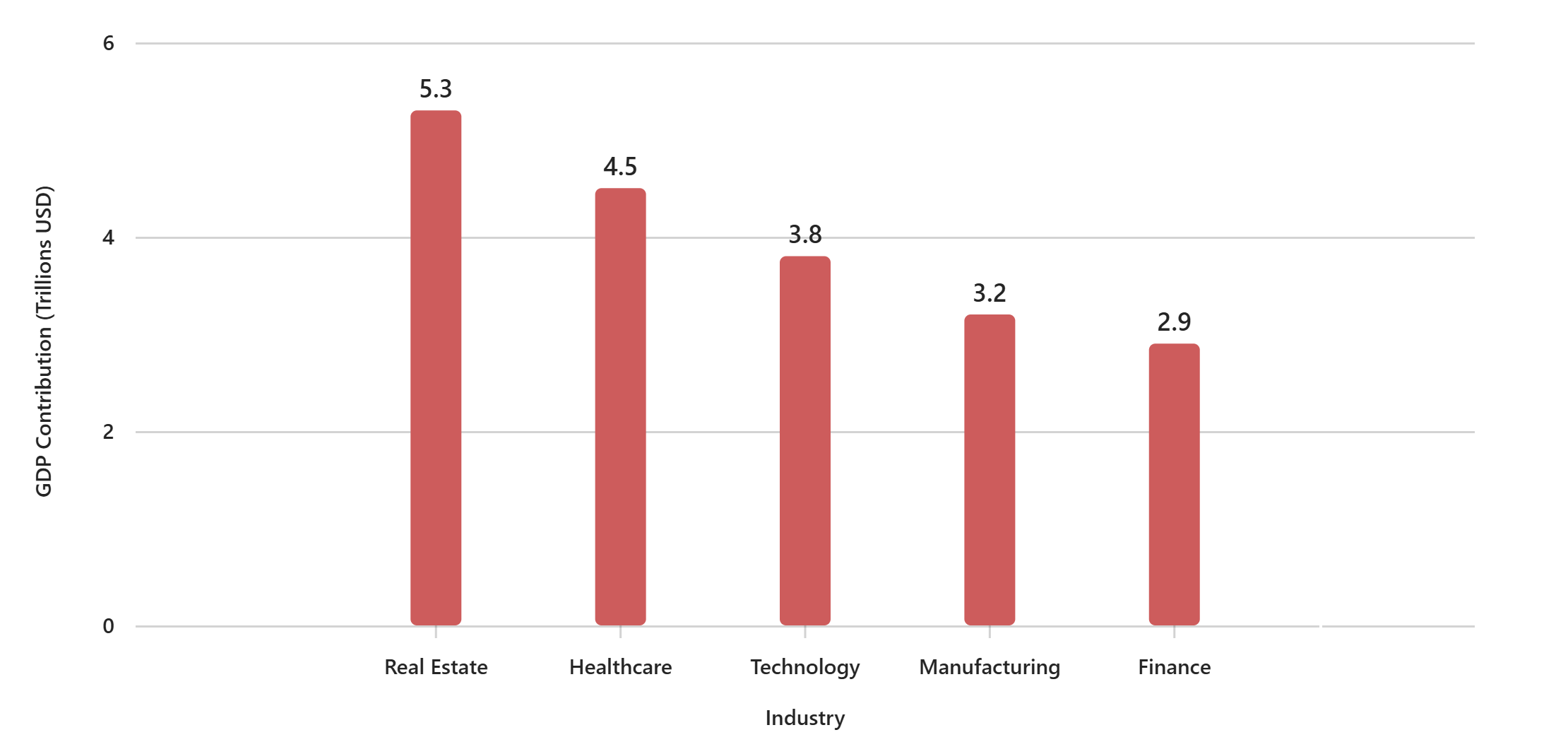

Real Estate Leads The Way!

💬 Real estate isn’t just about homes—it’s a powerhouse of the U.S. economy. In 2024, real estate industry contributed a massive and staggering $5.3 trillion to the U.S. GDP, outpacing industries like healthcare, tech, and manufacturing.That’s not just a number—it’s a reflection of how deeply real estate drives our economy.

🏡 From residential sales to commercial development, real estate touches every part of our lives. As a Realtor, I see firsthand how these numbers translate into dreams realized, communities built, and wealth created.📊 Check out this quick comparison—real estate leads the way!

💼 Whether you’re buying, selling, or investing, you’re part of this powerful movement. Let’s talk about how you can make smart moves in today’s market.

#RealEstate #GDP #MarketInsights #RealtorLife #GotoZuby #EconomicImpact #RealEstateTrends #GotoZuby #MarketTrends #Homeownership #LexingtonMA

Overpricing Your Home? Here’s What It Could Cost You…

The Hidden Cost of Overpricing Your Home!

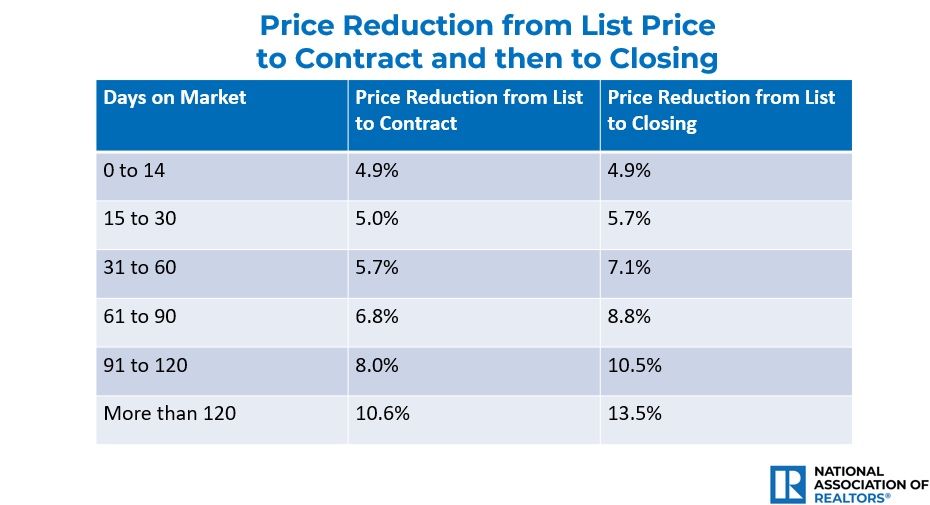

Setting the right price from day one is critical. Pricing a home incorrectly from the start can lead to costly consequences. Homes that linger on the market often face deeper price cuts—and even after a buyer signs a contract, the final sale price can still drop due to inspections and appraisals. The longer a property sits on the market, the steeper the price cuts tend to be. According to The National Association Research (NAR), on average, homes see an additional 2% price reduction between contract signing and closing.

📉 On average, sellers see an additional 2% price reduction from contract to closing.

If you are a Seller: Don’t leave money on the table!

Work with me or any knowledgeable agent who understands your local market and can help you price your home right from the start. Let’s talk about how to position and price your property for a successful sale and avoid costly consequences. Some tips to help get you started.

Here is how I or your agent can help by taking proactive steps to help keep the home moving and avoid losses:

- Staging and presentation upgrades to boost buyer interest

- Enhanced marketing efforts including virtual tours and social media

- Pre-listing inspections to avoid surprises later

- Flexible negotiation tactics to close deals faster

- Strategic price adjustments based on market feedback to avoid your property staying further on the market

Q2, 2005 MA Single Family Market Watch Report

Massachusetts Single Family Homes, Q2, 2005 Market Watch Report By MLSPIN

By County and Zip Code

Massachusetts Law Prohibits Landlords From Penalizing Tenants For Reasonable Wear And Tear

🏠 Tenant Rights: What Landlords Can’t Charge For

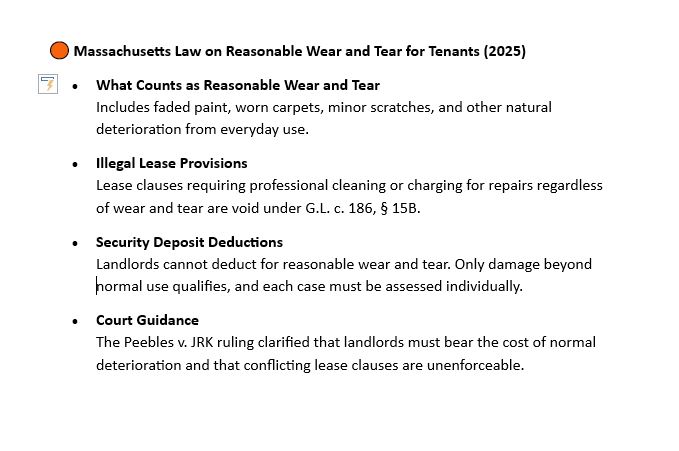

In Massachusetts, landlords cannot deduct from a tenant’s security deposit for reasonable wear and tear. This is protected under Massachusetts General Laws Chapter 186, Section 15B.

✅ What Is Considered “Reasonable Wear and Tear”?

These are normal signs of everyday living:

- 🎨 Faded paint

- 🧼 Minor carpet wear

- 🖼️ Small nail holes from hanging pictures

- 🚪 Light scuff marks on walls or floors

These cannot legally be charged to tenants.

🛑 What Landlords Cannot Do

- ❌ Require tenants to pay for professional cleaning or repainting due to normal use

- ❌ Include lease clauses that override these protections — such clauses are unenforceable and void

⚖️ Legal Precedent: Peebles v. JRK Property Holdings, Inc. (2025)

The Massachusetts Supreme Judicial Court ruled:

Deductions for cleaning, painting, or refurbishing due to normal use violate tenant protection laws.

💡 What Landlords Can Deduct

- 💸 Unpaid rent

- 🔧 Damage beyond normal wear (e.g., broken fixtures, holes in walls)

- 📄 Repairs with itemized receipts

See indepth law details here: Massachusetts General Laws Chapter 186, Section 15B

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link