MBTA Transit Line Price Per Square Foot

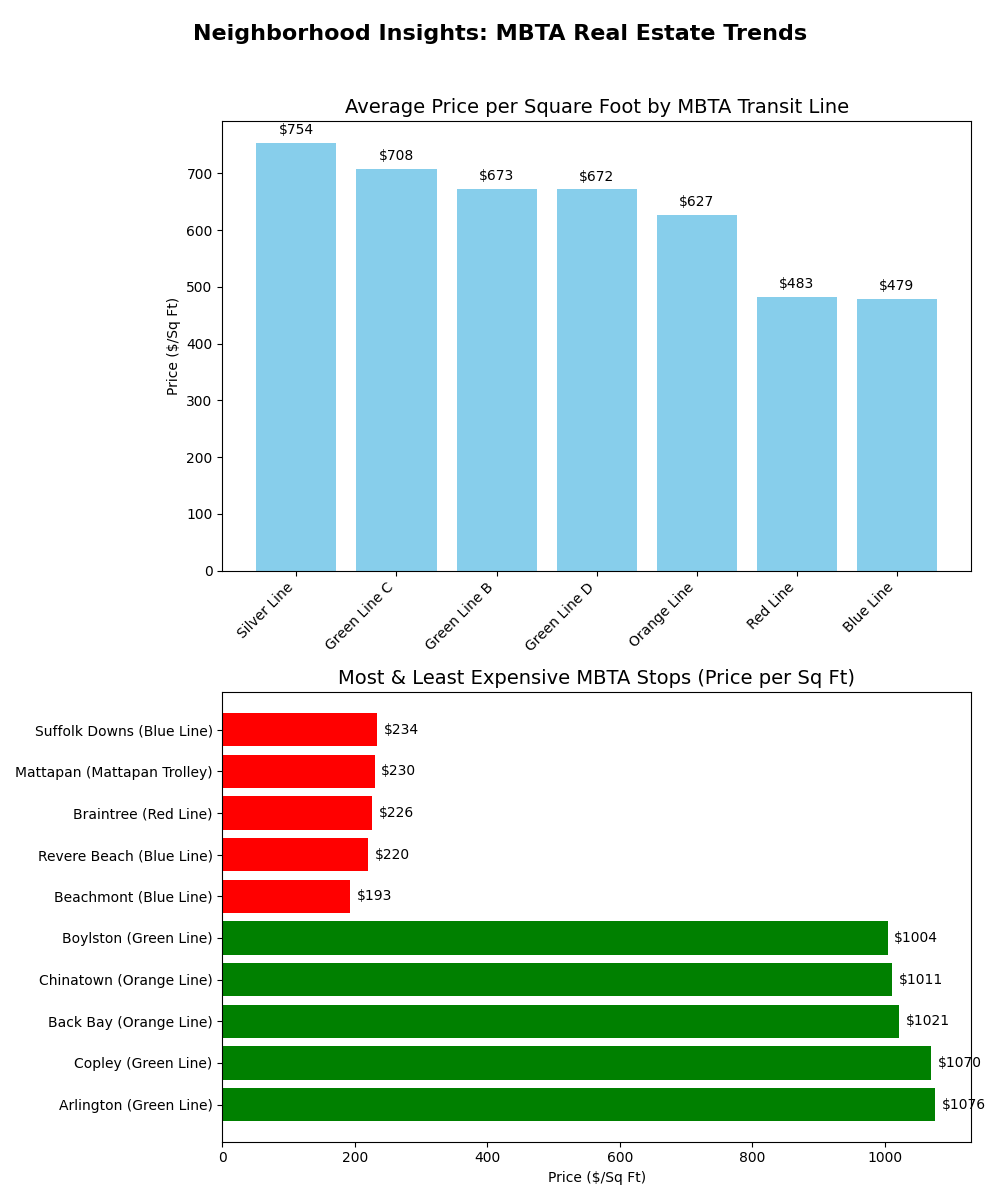

I asked AI, “What is the breakdown of price per square foot by MBTA transit line?”

Here’s what AI had to say about a breakdown of the average price per square foot by MBTA transit line in the Boston area, based on Estately’s analysis of home sales within a half-mile of each stop:

🏙️ MBTA Transit Line Price Per Square Foot

| Transit Line | Average Price/Sq Ft |

|---|---|

| Silver Line | $754 |

| Green Line C Branch | $708 |

| Green Line B Branch | $673 |

| Green Line D Branch | $672 |

| Orange Line | $627 |

| Red Line | $483 |

| Blue Line | $479 |

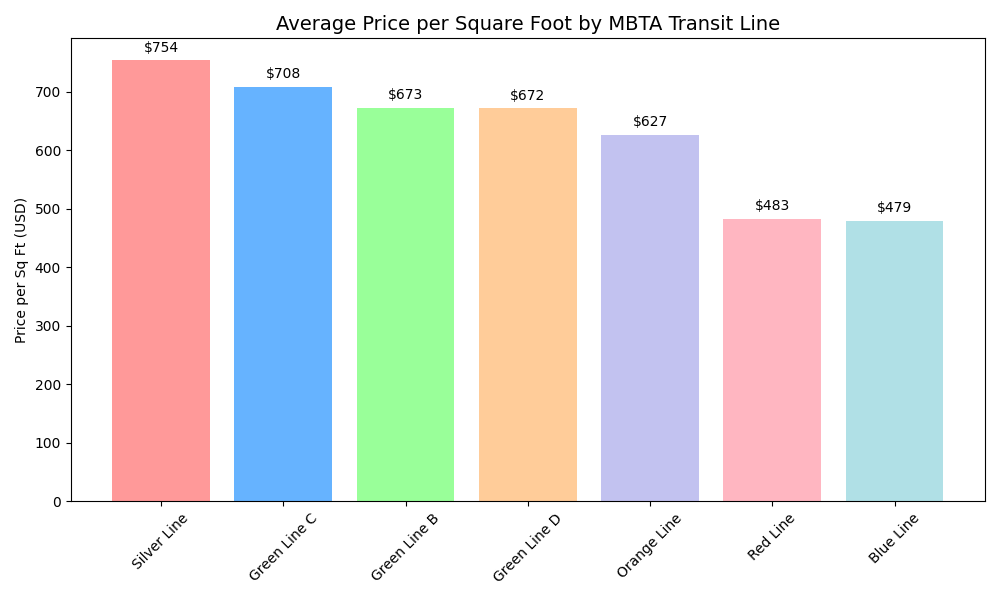

🚉 Most Expensive Stops (Price/Sq Ft)

- Arlington (Green Line) – $1,076

- Copley (Green Line) – $1,070

- Back Bay (Orange Line) – $1,021

- Chinatown (Orange Line) – $1,011

- Boylston (Green Line) – $1,004

🏘️ Least Expensive Stops (Price/Sq Ft)

- Beachmont (Blue Line) – $193

- Revere Beach (Blue Line) – $220

- Braintree (Red Line) – $226

- Mattapan (Mattapan Trolley) – $230

- Suffolk Downs (Blue Line) – $234

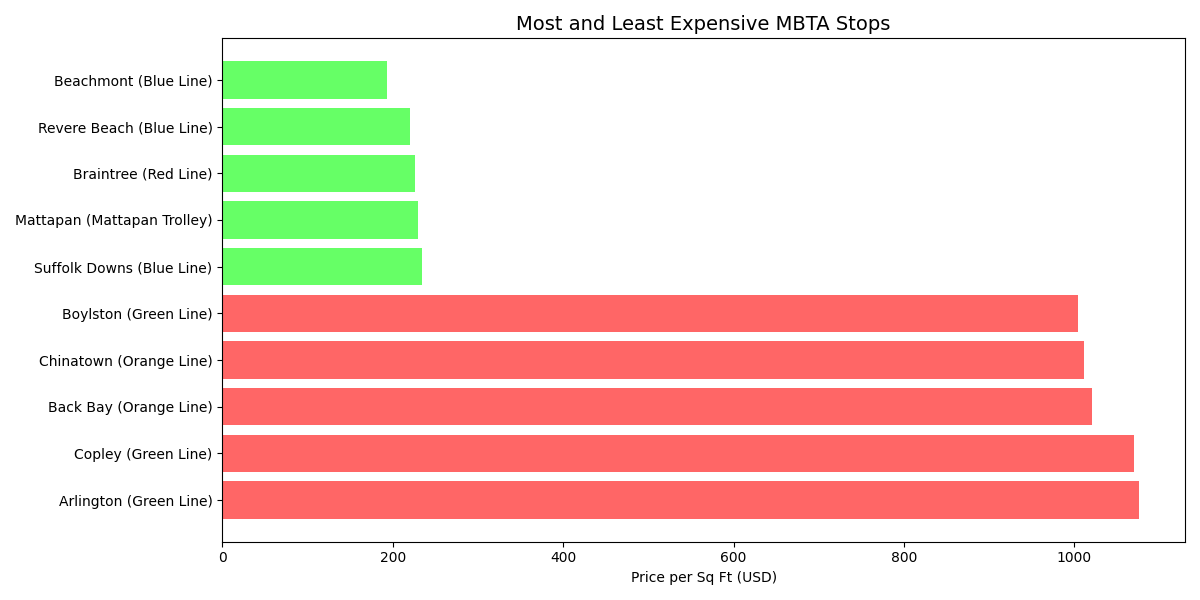

Please see the breakdown by stop and and T color line/branch

https://www.estately.com/boston-area-home-affordability-transit-stop

As can be seen per estately.com analysis,

Boston median price per square foot by transit line

Silver Line: Holds the highest average price per square foot at $754.

Green Line: Varies by branch, but generally high:

“C” Branch: $708

“B” Branch: $673

“D” Branch: $672

Orange Line: $627

Red Line: $483

Blue Line: $479

Most expensive/affordable areas near transit

Most expensive: Arlington Stop on the Green Line boasts the highest price per square foot at $1,076. Other expensive areas include Back Bay ($1.5K/sq ft) and Beacon Hill ($1.4K/sq ft) which are served by multiple lines.

Least expensive: Beachmont stop on the Blue Line was identified as the least expensive at $193 per square foot.

Commuter rail zones

The Commuter Rail system is divided into 11 fare zones (Zone 1A to Zone 10), with Zone 1A representing stations closest to downtown Boston. Commuter rail zones generally indicate distance from downtown. Specific median home prices per square foot by commuter rail zone were not identified in the search results but a strong correlation between proximity to the city center (lower zone numbers) and higher property values can be inferred.

Note: The above provided data comes from various sources and may reflect different timeframes. Some data, such as the analysis by Estately, is based on data from the last six months (as of when the analysis was published).

Case Study: Housing Affordability in Lexington, MA (2025)

🏡 Case Study: Housing Affordability in Lexington, MA (2025)

Lexington, Massachusetts continues to be one of the most competitive housing markets in the state. In June 2025, the median home sale price reached $2.1 million, marking a 29.2% increase year-over-year. This sharp rise reflects strong demand and limited inventory, making it a seller’s market.

📊 Key Stats:

- Median Price per SqFt: $568

- Average Days on Market: 15 days

- Sale-to-List Price Ratio: 104.4% (homes selling above asking)

- Homes Sold Over Asking: 62%

2. https://www.redfin.com/city/36128/MA/Lexington/housing-market

🛏️ Price by Bedroom Count (June 2025):

| Bedrooms | Median Price | YoY Change |

|---|---|---|

| 1 BR | $502,400 | -1.5% |

| 2 BR | $718,500 | -7.3% |

| 3 BR | $1.1M | +6.2% |

| 4 BR | $1.5M | +10.0% |

| 5+ BR | $2.6M | +12.4% |

🏘️ Inventory Trends:

- Total homes for sale: 139 (down 3.5% from May)

- Most homes sell within 30 days

- Inventory for 2-bedroom homes increased by 50%, while 1-bedroom homes dropped by 33%

2. https://www.redfin.com/city/36128/MA/Lexington/housing-market

💡 What This Means for Buyers

With prices rising and homes selling quickly, affordability is a growing concern. Buyers need to act fast, often competing with multiple offers and paying above asking. Lexington’s rising prices and fast-moving inventory make it a challenging market for first-time buyers and families with moderate incomes. With homes selling above asking and limited affordable options, many buyers are looking to nearby towns or considering reverse migration—moving to less expensive areas with more space and flexibility. For first-time buyers or those with moderate incomes, Lexington may be out of reach without significant financial planning or assistance.

For more on Housing Affordability Index check out my other blog explaining it. Let’s connect…

Housing Affordability Index

What does Housing Affordability Mean?

It refers to the relationship between household income and housing costs—essentially, whether people can reasonably afford to buy or rent a home without compromising their ability to pay for other essentials like food, healthcare, and transportation. Factors Affecting Affordability: Local wages and employment opportunities, Home prices and rental rates, Availability of housing stock (especially affordable units), Interest rates (for buyers), and Government policies and subsidies.

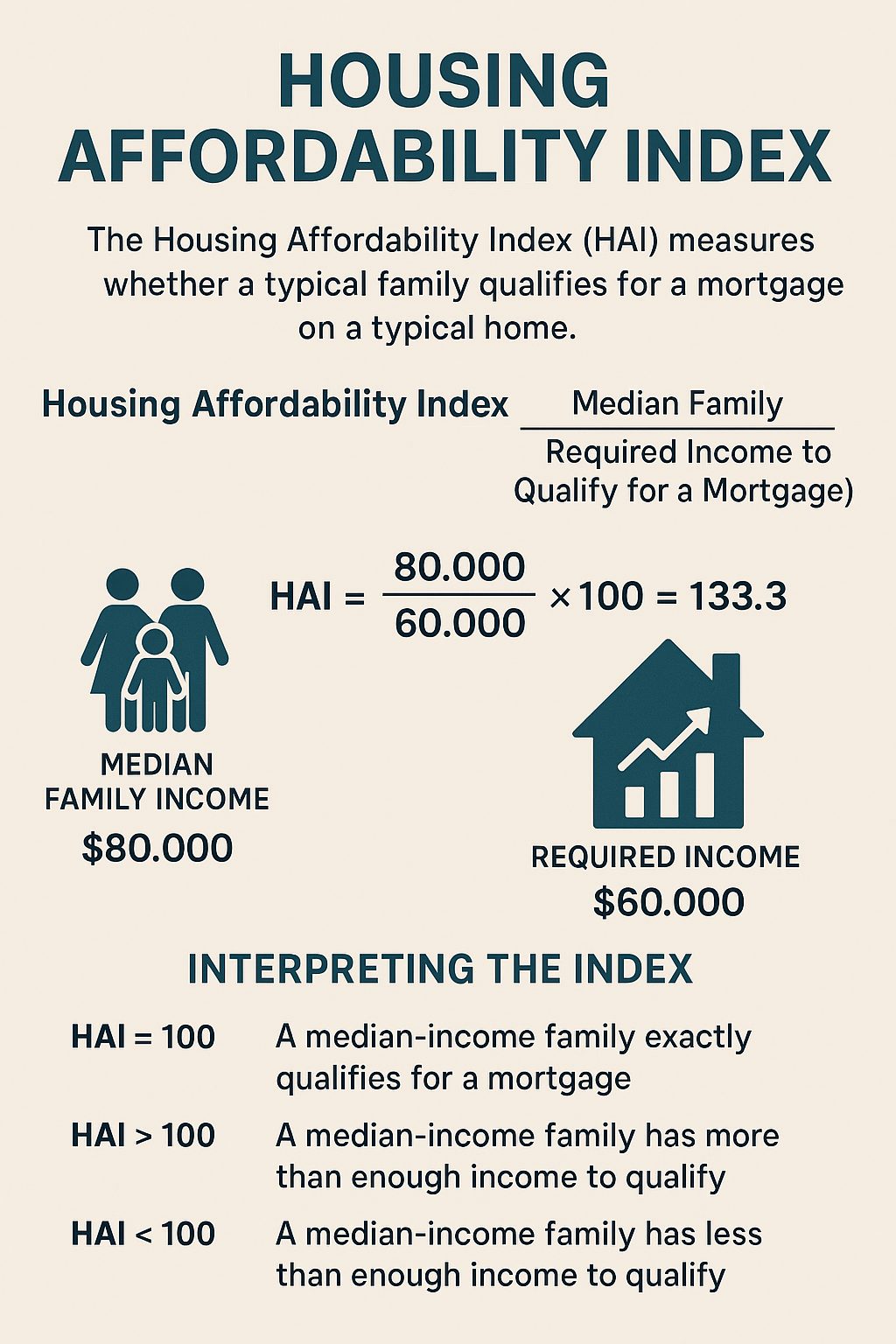

There is an Housing Affordability Index (HAI) that is put out by the National Association of Realtors (NAR) in the U.S. The Housing Affordability Index (HAI) is a measure used to determine whether a typical family earns enough income to qualify for a mortgage on a typical home. It’s a key tool in understanding how affordable housing is in a given area or time period. Based on a 30-year fixed mortgage with a 20% down payment and uses Freddie Mac’s mortgage rate data, assumes a 25% qualifying ratio, meaning housing expenses should not exceed 25% of gross monthly income.Their formula is:

Housing Affordability Index = (Median Family Income / Required Income to Qualify for a Mortgage) × 100

Median Family Income: The average income of a typical household.

Required Income: The income needed to qualify for a mortgage on a median-priced home, assuming:

20% down payment

30-year fixed mortgage

Standard qualifying ratio (usually 25% of income goes to housing costs)

📊 Interpreting the Index

- HAI = 100: A family earning the median income has exactly enough to qualify for a mortgage.

- HAI > 100: Housing is more affordable—the family earns more than needed.

- HAI < 100: Housing is less affordable—the family earns less than needed.

🏠 Example

If the median income is $80,000 and the income needed to afford a median-priced home is $60,000:

This means the typical family earns 33% more than needed to afford a home.

Why Does It Matter?

Lack of affordable housing can lead to overcrowding, homelessness, and economic instability. It affects where people can live, work, and raise families—impacting everything from education access to job opportunities. NAR puts out a Metro Market Statistics Dashboard showing the stats for each of these factors. There are currently many challenges and the implications of the current housing affordability crisis for buyers in 2025 are significant and multifaceted.

Here’s a breakdown of the key challenges and trends:

🏠 1. Rising Home Prices and Mortgage Costs

- Home prices have surged nearly 60% since 2019, with the median existing single-family home now costing $412,000, which is five times the median household income

1. https://www.realtor.com/news/trends/affordability-crisis-home-prices-record-household-income-housing-report-2025/

- Monthly mortgage payments have increased dramatically, now averaging $2,570, which is 40% higher than in 1990 (adjusted for inflation)

1. https://www.realtor.com/news/trends/affordability-crisis-home-prices-record-household-income-housing-report-2025/

- Buyers now need to spend 45% more of their income on mortgage payments compared to 2019

2. https://www.jpmorganchase.com/institute/all-topics/community-development/the-affordability-gap-is-home-ownership-still-within-reach-in-todays-economy

📉 2. Declining Affordability Index

- The U.S. Housing Affordability Index dropped from 150 in 2021 to the mid-80s by 2024, indicating a sharp decline in affordability

3. https://resimpli.com/blog/housing-affordability-statistics/

- Only 60% of U.S. counties are affordable for households earning the local median income, down from 90% five years ago

3. https://resimpli.com/blog/housing-affordability-statistics/

🧓 3. Changing Buyer Demographics

- The average age of first-time homebuyers rose to 38 years old, as younger buyers struggle to afford homes

2. https://www.jpmorganchase.com/institute/all-topics/community-development/the-affordability-gap-is-home-ownership-still-within-reach-in-todays-economy

- Millennials make up 70% of first-time buyers, but many are priced out due to stagnant wages and rising costs

3. https://resimpli.com/blog/housing-affordability-statistics/

🏘️ 4. Shifts in Buyer Preferences

- Suburban housing is preferred by 56% of buyers, likely due to lower prices compared to urban centers

3. https://resimpli.com/blog/housing-affordability-statistics/

- Modular and small homes are gaining popularity, with 67% of respondents believing they will become mainstream

3. https://resimpli.com/blog/housing-affordability-statistics/

💸 5. Financial Strain and Cost Burden

- 31.8% of households are cost-burdened, spending more than 30% of their income on housing

3. https://resimpli.com/blog/housing-affordability-statistics/

- In cities like Boston, property taxes and insurance add up to $1,000/month on top of mortgage payments

1. https://www.realtor.com/news/trends/affordability-crisis-home-prices-record-household-income-housing-report-2025/

🔒 6. Lock-In Effect and Inventory Shortage

- Many homeowners are reluctant to sell due to low existing mortgage rates, reducing inventory and pushing prices higher

1. https://www.realtor.com/news/trends/affordability-crisis-home-prices-record-household-income-housing-report-2025/

- Housing inventory has decreased by 30% since 2019, further limiting options for buyers

3. https://resimpli.com/blog/housing-affordability-statistics/

🧠 Implications for Buyers

- Affordability planning is critical: Buyers must reassess budgets and consider longer mortgage terms or alternative housing types.

- Expect lifestyle compromises: Many are opting for smaller homes, suburban locations, or extensive renovations to make purchases feasible.

- Financial literacy and preparation: With rising down payments and closing costs, buyers need stronger financial strategies and savings.

A local Example of the House Affodability

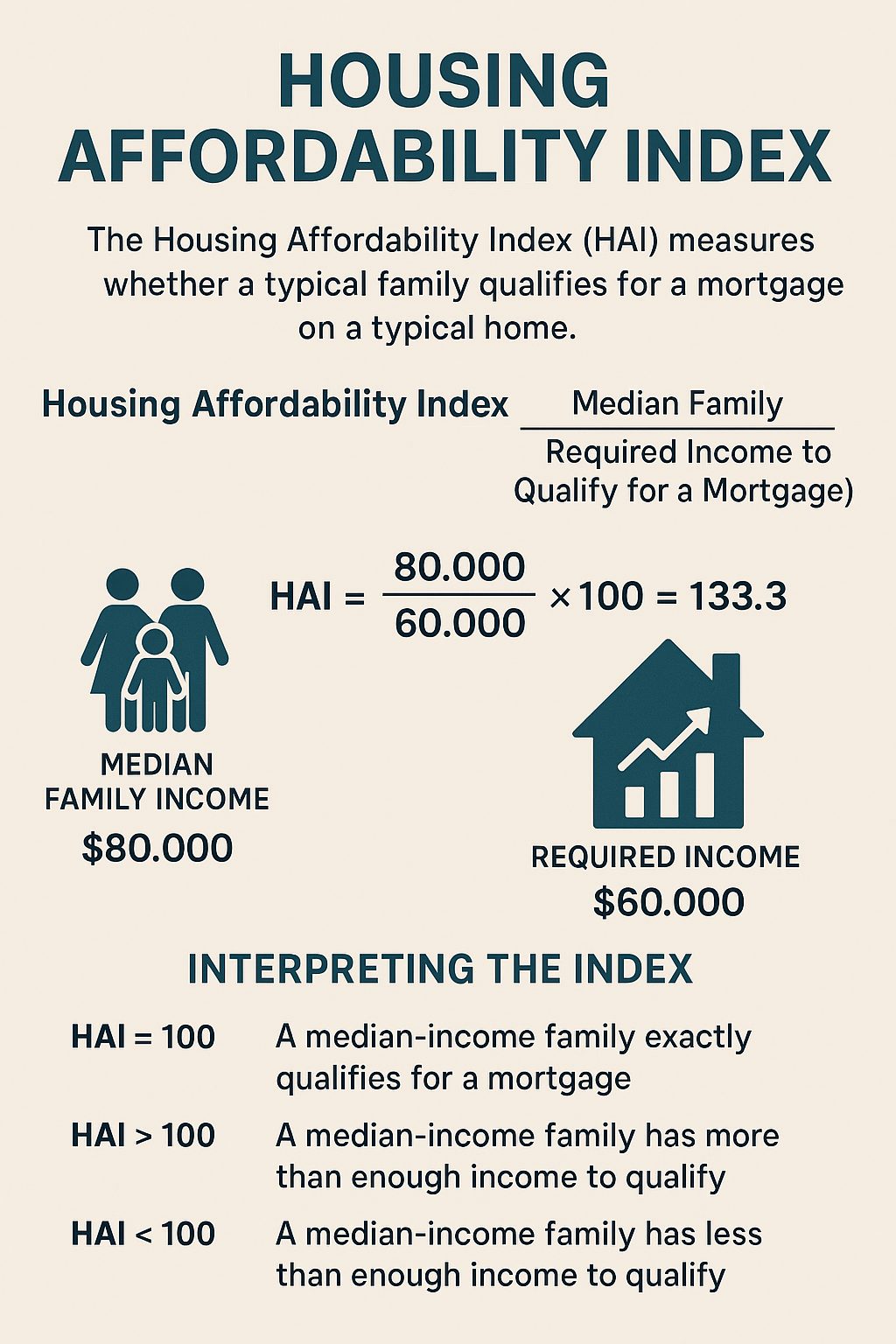

A report put out by NAR shows the most recent housing, demographic, economic and affordability statistics for Boston-Cambridge-Newton, MA-NH area.

- https://www.nar.realtor/research-and-statistics/housing-statistics/metro-market-statistics

Here are some staggering statistics for the share of income that homeowners and renters spend on housing. 30% or higher is considered cost-burdened.

🏠 Key Affordability Metrics

- Monthly Mortgage Payment: $4,346

- Qualifying Income: $208,608

- Housing Affordability Index (HAI): 70.2

- A lower HAI indicates reduced affordability. A value of 100 means a median-income household can afford a median-priced home. At 70.2, affordability is significantly below the national benchmark.

- Price-to-Income Ratio: 5.7

- This is quite high. A healthy ratio is typically around 3–4.

- Payment-to-Income Ratio: 35.6%

- This exceeds the recommended threshold of 30%, suggesting that housing costs are burdensome for many buyers.

📊 Housing Cost Burden by Tenure

Homeowners

- 72.8% spend less than 30% of income on housing (considered affordable).

- 27.2% are cost-burdened:

- 15.0% spend 30–50%

- 4.4% spend 50–70%

- 7.1% spend more than 70%

Renters

- Only 45.3% spend less than 30% of income on rent.

- A significant 54.7% are cost-burdened:

- 23.6% spend 30–50%

- 14.6% spend 50–70%

- 16.9% spend more than 70%

🔍 Renters are more severely impacted by affordability challenges than homeowners.

👥 Affordability by Age Group

All Households (Owners + Renters)

- 35–44 and 45–64 age groups have the highest affordability (≈38.8%)

- Under 25: Only 9.5% can afford a median-priced home

- 65+: Just 16.6% can afford

Renters Only

- Under 25: 9.1% can afford

- 25–34: 22.7%

- 35–44: 16.2%

- 45–64: 10.2%

- 65+: 1.5%

🔍 Older renters (especially 65+) face the greatest affordability challenges, likely due to fixed incomes and lack of home equity.

🧭 Overall Takeaways

- Affordability is a key and most urgent challenge in today’s housing market.

- Given the high house prices and tight inventory, many nuyers are holding on in this market and their dreams of owning a home the traditional way is just that, a dream still.

- Boston MA-NH is one of the least affordable metro areas in the U.S.

- High housing costs are disproportionately affecting renters, young adults, and seniors.

- The HAI of 70.2 and payment-to-income ratio of 35.6% highlight systemic affordability issues.

- Policy implications could include expanding affordable housing, rent control measures, and targeted assistance for vulnerable age groups.

Rental Law in MA (Bill H.336) – effective August 1, 2025

Here’s a comprehensive overview of Massachusetts rental laws as of 2025, including recent updates and long-standing regulations that affect both tenants and landlords:

🔹 Key 2025 Rental Law Changes

Effective August 1, 2025, Massachusetts passed Bill H.336, which introduces major reforms:

- Broker Fees:

- ONLY the party who hires the broker (tenant or landlord) is responsible for paying the fee.

- Tenants are no longer automatically required to pay broker fees unless they voluntarily hired the broker themselves.

- Dual Agency Ban:

- Real estate agents cannot represent both the landlord and tenant in the same transaction to avoid conflicts of interest.

- Lease Signing Timeline:

- Leases cannot be signed more than 3 months before the lease start date or the end of the current lease.

- This limits early lease lock-ins, especially in cities like Boston where early leasing was common

1. https://www.centrerealtygroup.com/massachusetts-rental-law-2025-tenant-landlord-guide/

🔹 General Landlord-Tenant Laws in Massachusetts

🏠 Landlord Responsibilities

- Provide a habitable dwelling (heat, hot water, pest control, smoke/CO detectors, etc.).

- Make repairs within 14 days of written notice.

- Maintain compliance with the State Sanitary Code (105 CMR 410).

👤 Tenant Responsibilities

- Pay rent on time.

- Keep the unit clean and sanitary.

- Avoid disturbing neighbors or damaging the property

2. https://ipropertymanagement.com/laws/massachusetts-landlord-tenant-rights

🔹 Security Deposits

- Maximum: One month’s rent.

- Must be held in an interest-bearing account.

- Landlords must provide:

- A receipt

- A condition statement within 10 days of move-in.

- Must return the deposit within 30 days of lease end, minus allowable deductions (e.g., unpaid rent, damages)

2. https://ipropertymanagement.com/laws/massachusetts-landlord-tenant-rights

🔹 Evictions

- 14-Day Notice for nonpayment of rent.

- 7-Day Notice for lease violations.

- 30-Day Notice for no-cause or end-of-lease evictions.

- Retaliatory or discriminatory evictions are illegal.

🔹 Rent Increases

- No statewide rent control (except in Cambridge).

- Landlords can raise rent by any amount with 30 days’ notice (or longer, depending on rent payment frequency).

- Increases cannot be retaliatory or discriminatory

2. https://ipropertymanagement.com/laws/massachusetts-landlord-tenant-rights

🔹 Landlord Entry

- Must give reasonable notice (typically 48 hours) for repairs or inspections.

- Entry allowed for:

- Maintenance

- Showings

- Emergencies

- Court orders

CheatSHeet For New Rental Law Effective August 1, 2025

Can Tenant Go Directly To Listing Agent And Avoid Paying Broker Fee?

Yes, a tenant in Massachusetts can go directly to the listing agent and apply for a rental unit without being represented by their own agent — but there are important legal boundaries and protections in place as of August 1, 2025, under the new rental law (Bill H.336):

✅ What Tenants Can Do

- Contact the listing agent directly (e.g., via Zillow, Instagram, or a brokerage site).

- Tour the property and fill out paperwork without hiring their own agent.

- Not be charged a broker fee if the listing agent was hired by the landlord.

⚠️ What Listing Agents Can and Cannot Do

- They must disclose in writing:

- Who hired them (usually the landlord).

- Who is paying their fee.

- The amount of the fee.

- They cannot charge the tenant unless the tenant explicitly hired them to represent their interests.

- Dual agency is banned — the same agent cannot represent both the landlord and the tenant in the same transaction

3. https://www.centrerealtygroup.com/massachusetts-rental-law-2025-tenant-landlord-guide/

📝 Example Scenario

If a tenant sees a listing on Zillow and contacts the agent listed:

- That agent is likely representing the landlord.

- The tenant can proceed unrepresented.

- The agent must not charge the tenant a broker fee.

- The tenant can still negotiate, apply, and sign the lease directly.

🏢 What About Apartment Referral Services & Third-Party Platforms?

These include services like:

- Zillow, Apartments.com, Rent.com

- Local referral agencies or apartment matchmakers

✅ What the Law Says

- Broker fees can only be charged to the party who hired the broker.

- If the landlord hired the referral service or listing agent, the landlord pays.

- If the tenant voluntarily hires a broker or referral service to help them find an apartment, the tenant pays

2. https://www.cbsnews.com/boston/news/broker-fee-laws-massachusetts-renters-takes-effect/

- Dual agency is banned — even if the referral service tries to represent both sides, it’s no longer legal.

- Written disclosure is required:

- Tenants must be told who hired the agent, who pays the fee, and how much — before signing anything.

⚠️ Important for Tenants Using Referral Services

- If you’re just browsing listings or contacting a listing agent directly, you are not hiring the broker.

- You should not be charged a fee unless you explicitly agree to work with a referral agent.

- Always ask:

- “Who hired you?”

- “Will I be charged a fee?”

- “Can I see the written disclosure?”

This law change will reshape and affect rental cyclesaccross the state and especially in Boston area where the housing market relies on being in a predictable cycle, i.e., many leases start with a September 1 move-in date when the student population is at its highest peak. Although, these rules are aimed to help tenants with their upfront costs, many of the tenants may end up going unrepresented since they will directly go to the listing agent to avoid paying the broker fee and achieve a saving there. The shortened lead time and the new limited broker role will have some consequences for the livelilhood of those agents relying on tenant paid compensation. Time will tell. In addition, this law will help reduce some of the high-pressure leasing tactics used by landlords given that leases can’t be signed way in advance, plus it will limit some of the early lock-in lease date; especially in the heavy student populated Boston area. It is possible that the rents may even go higher since the landlords will increase the rent to offset this additional broker fee cost and end up passing the cost to the tenant indirectly.

Let’s connect. I can help navigate you through the rental journey.

What is 40Y?

40Y is the Starter Home Zoning Districts Act which was enacted in 2022 via the Economic Growth and Relief for the Commonwealth (Acts of 2022, Chapter 268), and it encourages the creation of starter home districts with a gola to help reduce barriers to create smaller and more affordable starter homes. According to mass.gov, “A “starter home” is a smaller single-family home suitable for first-time home buyers, downsizing, smaller households, and people needing a more affordable single-family housing option.” It is part of a bigger strategy to encourage diverse housing choices while creating abundant housing in the state. Per the law, According to mass.gov,

“These homes are designed for someone buying their first home, downsizing, or for smaller households. The law sets certain key rules for these homes:

At least 50% of the homes in a Starter Home Zoning District must have three or more bedrooms,

At least 10% of the homes must be made affordable for households making up to 110% of the area median income.

The zoning must allow Starter homes to be built as-of-right, rather than through special permits.

Starter homes can be up to 1,850 square feet in heated living space.

Starter Home Zoning Districts must allow at least 4 starter homes per acre.”

To read more, read: https://www.mass.gov/info-details/starter-homes-program-chapter-40y

Happy to chat and review your options. Let’s connect

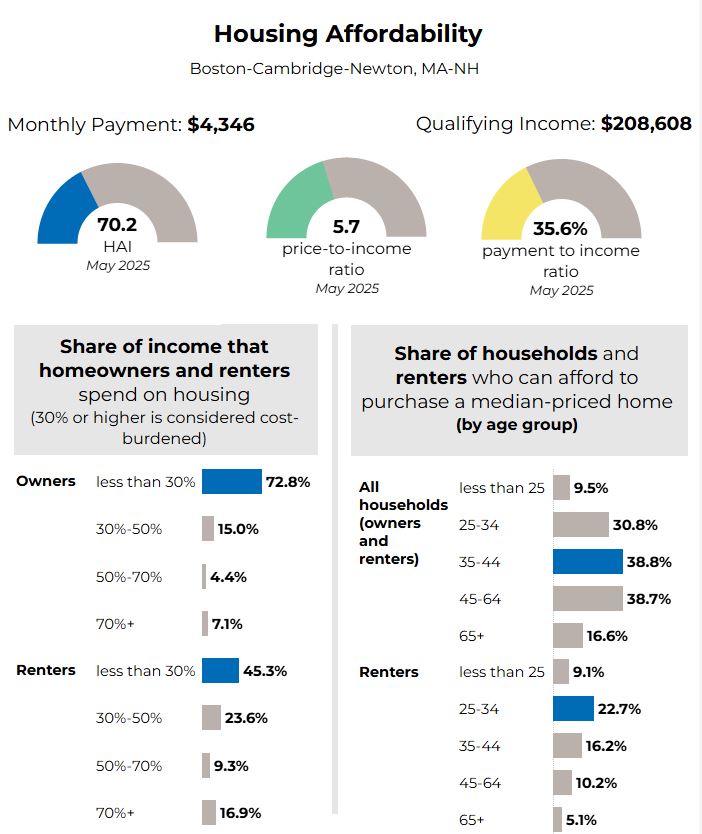

Reverse Migration

🔄 Reverse Migration in Real Estate

In recent years, a surprising trend has emerged in the U.S. housing market:

Reverse migration refers to a shift in population movement that goes against traditional patterns. In real estate, this typically means:

- People moving away from large urban centers or popular Sunbelt states (like Florida, Texas, and California)

- Returning to smaller cities, rural areas, or Northern regions that were previously experiencing population decline and were less populated, often overlooked areas.

- It’s a reversal of the decades-long trend of urbanization and southern migration.

This shift is reshaping real estate markets across the country—and creating new opportunities for buyers, sellers, and investors. However, after the pandemic there has been a trend of some people moving back into states like Massachusetts.

🌍 What’s Driving the Shift? Why Is Reverse Migration Happening?

Several factors are driving this trend:

1. Climate Risks

- Rising insurance costs and frequent natural disasters (wildfires, hurricanes, floods) in coastal and southern states are making these areas less attractive.

- Northern cities like Detroit, Buffalo, and Milwaukee are seeing renewed interest due to lower climate risk

1. https://diversifiedtrust.com/blog/reverse-migration/

2. Affordability

- Skyrocketing home prices in metro areas have pushed buyers to seek more affordable housing in smaller cities and rural towns.

- Reverse migration is helping revitalize housing markets in previously overlooked regions

2. https://realtytimes.com/consumeradvice/item/5837-20080117_reversemigrate

3. Remote Work

- The rise of remote and hybrid work models has freed people from needing to live near job centers.

- Many are choosing locations based on quality of life, space, and cost, rather than proximity to offices

3. https://www.ashianahousing.com/real-estate-blog/reverse-migration-is-it-here-to-stay/

4. Lifestyle Shifts

- Post-pandemic priorities have shifted toward health, space, and community.

- Smaller towns offer lower density, less pollution, and more personalized healthcare access.

🏘️ What Are The Implications And What Does This Mean For Real Estate

For Buyers:

- More options in emerging markets with lower prices and better value.

- Opportunity to invest in up-and-coming areas before demand spikes.

For Sellers:

- Properties in traditionally “slow” markets may now attract new interest.

- Time to reassess pricing and marketing strategies based on shifting demand.

For Investors:

- Reverse migration opens doors to revitalization projects, multifamily housing, and long-term rental opportunities in overlooked regions.

📌 Reverse migration is more than a trend—it’s a reflection of changing values, economic realities, and climate awareness. As people rethink where and how they want to live, the real estate landscape is evolving in exciting ways. Whether you’re buying, selling, or investing, understanding this shift can help you stay ahead of the curve.

How is Massachusetts doing?

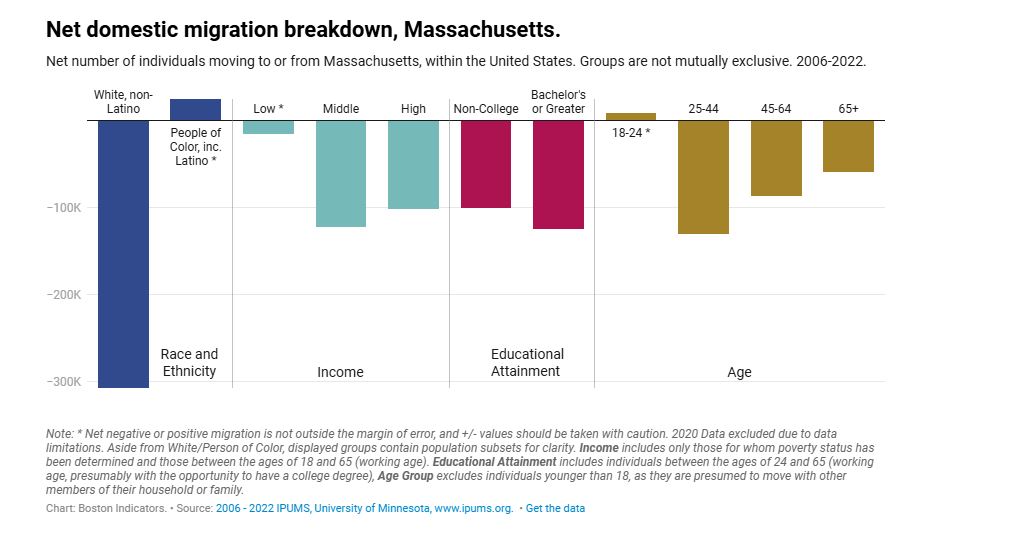

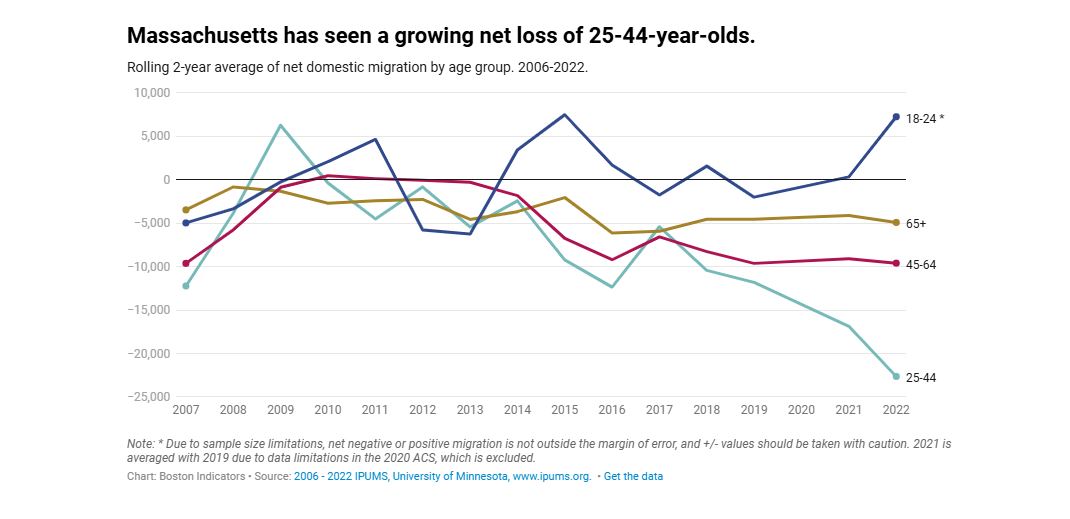

Now let’s change gear to see its impact of the reverse migration phenomenon in Massachusetts—where more residents are leaving the state than moving in.

This phenomenon has had a profound impact on the MA real estate market, especially in terms of housing demand, affordability, and development patterns. Here’s how this trend is reshaping real estate in the state of MA:

🏠 Reverse Migration & Real Estate in Massachusetts

1. Declining Demand in Key Demographics

The largest group leaving Massachusetts is young adults aged 25–44, especially those in their family formation years

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

These individuals are typically first-time homebuyers, and their departure reduces demand for starter homes and entry-level housing.

The loss of middle- and high-income earners—who would otherwise be active in the housing market—further weakens demand

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

2. Affordability Crisis Driving Migration

The median income needed to afford a home in Massachusetts is over $162,000, more than twice the average income of young adults. Hence, we see a trend in outmigration for MA – The state is losing young adults in higher numbers of 25–44-year-olds (critical mass age group) leaving than any other age group. This in turn affects Revenue collected by IRS in taxes, an age where they are buying homes, having children, etc. and other impacts.

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

High rental costs and home prices are pushing residents to more affordable states like New Hampshire, Florida, and North Carolina. Even high earners are finding it difficult to buy due to low inventory and high competition, especially in Greater Boston

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

3. Impact on Housing Supply & Development

Developers face challenges in building affordable housing due to zoning restrictions, labor shortages, and rising construction costs.

Despite the passage of Chapter 40Y to promote starter home development, no new zoning districts have been adopted as of mid-2024

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

4. Urban Real Estate & Rental Market Shifts

As young professionals leave, urban rental markets may experience higher vacancy rates, especially in areas dominated by student or young adult housing.

The absence of zoning for non-university student housing in Boston limits options for graduate students and young renters, pushing them out of the city

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

5. Long-Term Economic Risks

The outmigration of working-age residents threatens the future buyer pool, leading to slower home sales and stagnant price growth in some areas.

A shrinking workforce also impacts commercial real estate, as fewer businesses expand or relocate to Massachusetts

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

🔍 Summary

Reverse migration is not just a demographic trend—it’s a real estate disruptor. It reduces demand, strains affordability, and complicates development. Without bold action to expand housing supply and affordability, Massachusetts risks losing the very residents who drive its housing market and economy.

Now let’s see the impact of Reverse migration in Massachusetts on the rental market . This has had a complex impact on rental prices, shaped by both demand shifts and supply constraints. Here’s how:

📉 Demand Pressure from Outmigration

- Young adults (ages 25–44), who make up a large portion of renters, are leaving Massachusetts at record rates

- This demographic shift reduces renter demand, especially in urban areas like Greater Boston, where many of these individuals previously lived.

- A Greater Boston Chamber of Commerce survey found that 83% of young adults cited rent costs as a key factor in deciding whether to stay

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

📈 Supply Constraints Keep Prices High

- Despite falling demand from domestic outmigration, rental prices remain elevated due to:

- Low vacancy rates across both new and older rental units

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

- Insufficient housing construction, especially affordable units.

- Zoning restrictions and lack of student housing options, which push renters into family-oriented units

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

- Low vacancy rates across both new and older rental units

🏙️ Urban Rental Market Dynamics

- In cities like Boston:

- High-income renters still face limited options due to constrained supply.

- Graduate students and young professionals often compete for units not designed for shared living, driving up prices.

- The lack of zoning for non-university student housing further tightens the market

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

⚖️ Net Effect on Rental Prices

- Short-term: Prices remain high due to supply shortages, even as some demand declines.

- Long-term: If outmigration continues and housing supply improves, rental prices may stabilize or decline, especially in areas losing population.

- However, international immigration and low-income housing demand may offset domestic losses, keeping rental markets competitive

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

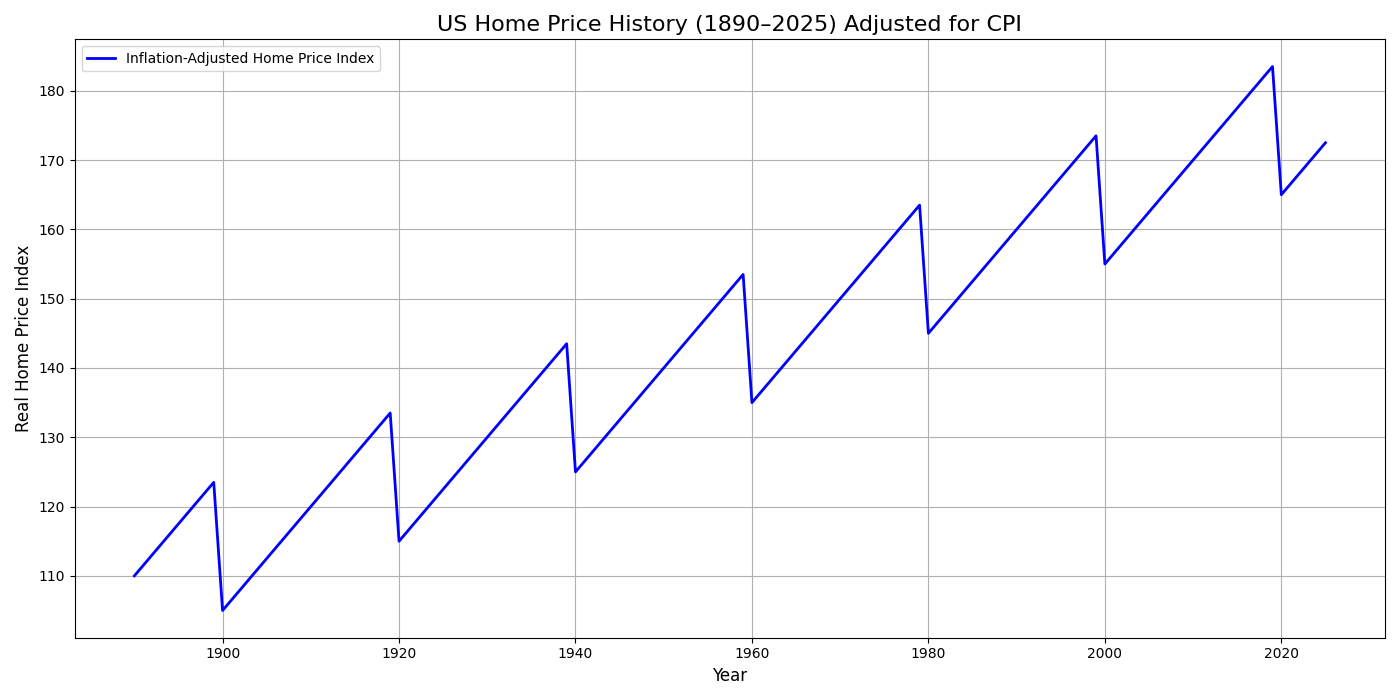

US Home Price History from 1890 to 2025

Historically, US home prices have risen faster than the overall rate of inflation, as measured by the consumer-price-index-CPI.

This pronounced trend in recent decades, impacts housing affordability. Need to focus and understand the factors driving this disparity. Here are some key trends and observations (See data sources below):

- Long-Term Outpacing of Inflation: Since 1963, home prices have risen significantly faster than inflation. Housing prices have increased more than 2,350%, while inflation has risen 896% in that same period.

- Decade-specific comparisons:

- Since 1970, home prices have increased 1,608%, compared to a 644% increase in inflation.

- From 1984 to 2023, the median new home cost increased by 423%, more than double the rate of overall price inflation (203%).

- Factors influencing the disparity: Several factors contribute to home prices increasing faster than inflation, including:

- Low supply and high demand: Demand for housing often outstrips the pace of new construction, driving up prices.

- Low interest rates: Historically low mortgage rates have made homes more affordable and stimulated demand.

- Inflationary environment: Increases in building material costs and other equipment expenses can contribute to higher new home prices.

- The 2006 Bubble and Recovery: Inflation-adjusted home prices peaked in 2006, followed by a significant decline during the subprime mortgage crisis. Since then, prices have rebounded strongly.

- Case-Shiller Home Price Index: This widely cited index tracks changes in single-family home prices and is available from 1890 onwards.

- Federal Housing Finance Agency (FHFA) House Price Index: This comprehensive index extends back to the mid-1970s and tracks changes in single-family home values.

- Bureau of Labor Statistics (BLS): Provides the Consumer Price Index (CPI), used to measure inflation.

- Few Real Estate Data Companies: Provide valuable data on home prices and market trends.

Thus, the data indicates that US home prices have outpaced inflation over the long term. This trend has implications for housing affordability, particularly for younger generations and those with lower incomes.

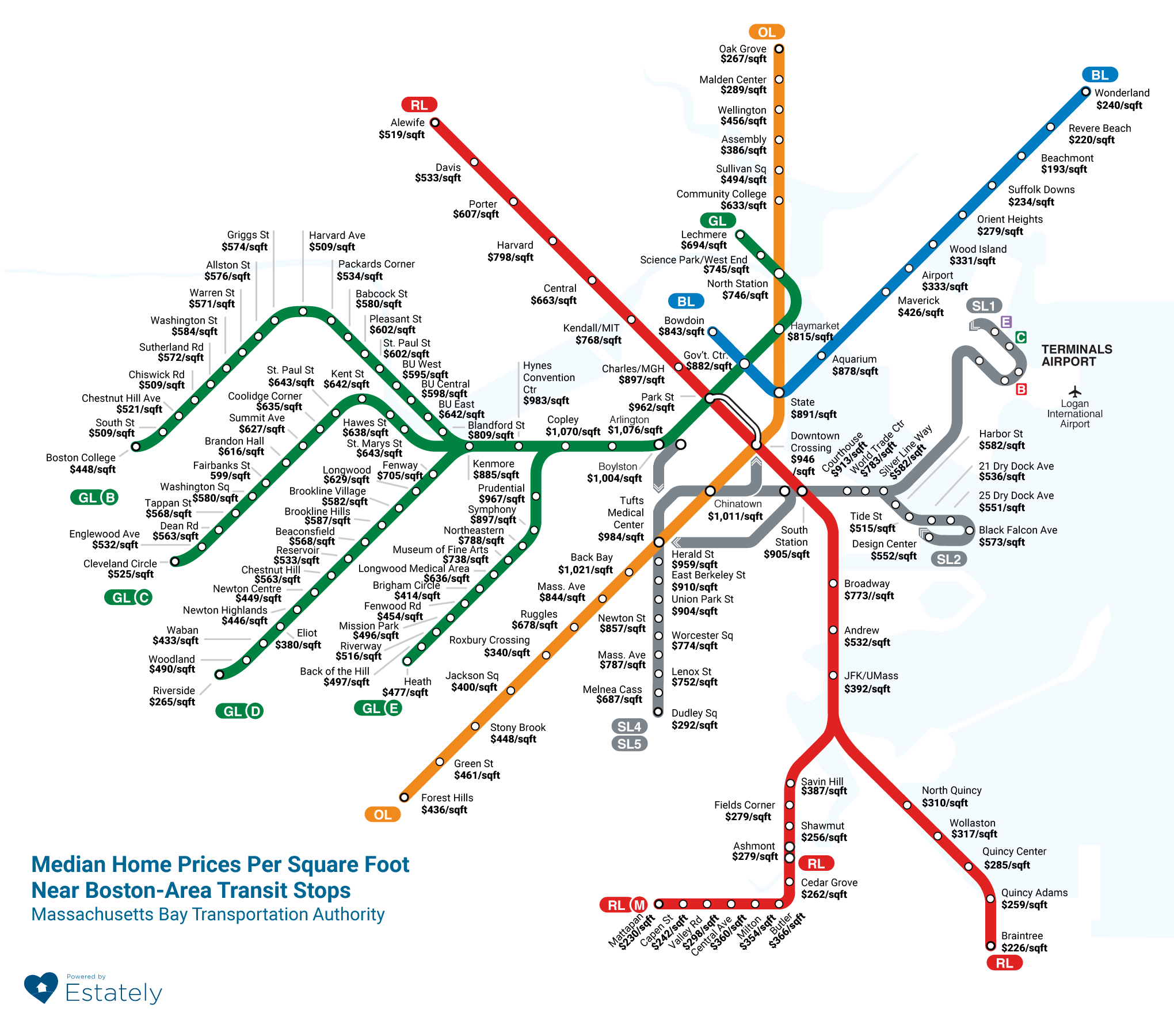

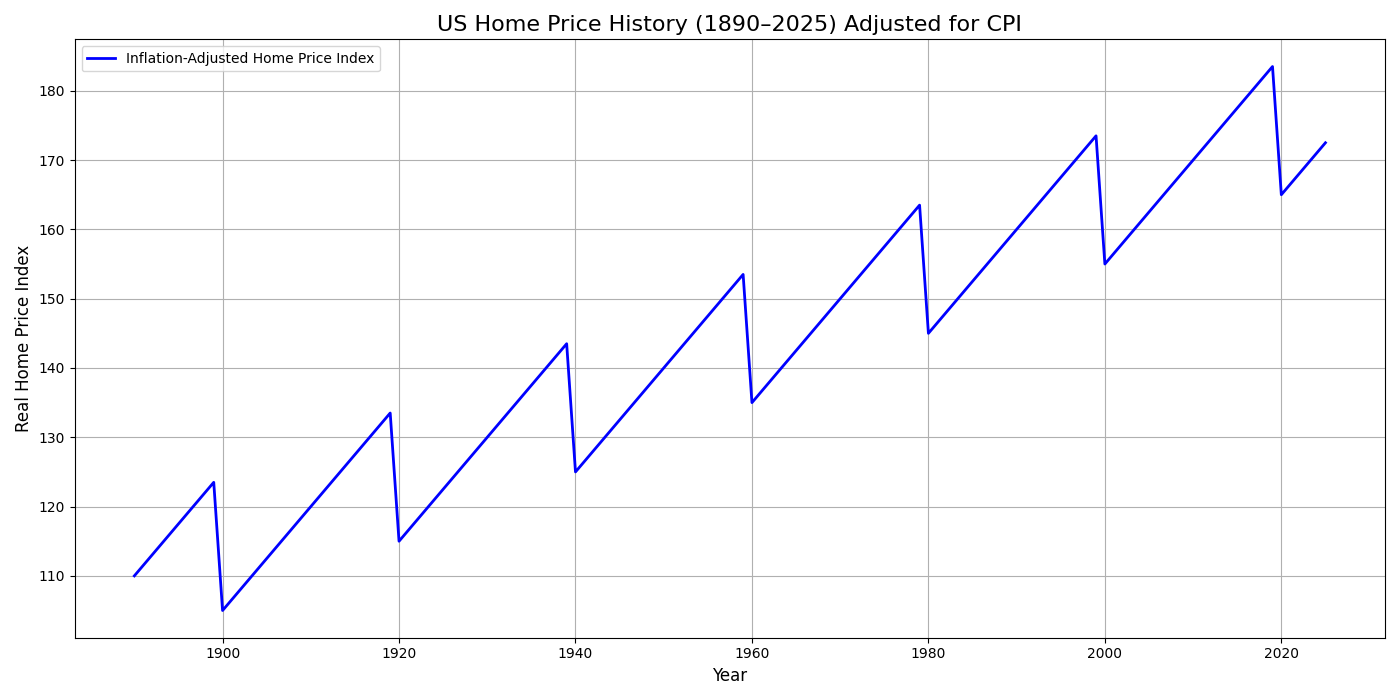

Here is the inflation-adjusted graph of U.S. home prices from 1890 to 2025, based on Robert Shiller’s historical housing data and CPI:

🏡 US Home Price History (1890–2025) Adjusted for CPI

This chart shows how home prices have evolved over more than a century, accounting for inflation to reflect real purchasing power and long-term value trends.

Demystifying the Downsizing Process: A Smart Guide to Living with Less

🧳 Downizing

Whether you’re an empty nester, a retiree, or simply seeking a more manageable lifestyle, downsizing your home can be a liberating and financially savvy move. But the process can feel overwhelming—emotionally, logistically, and even financially. At gotozuby.com, I am here to help you demystify the downsizing journey and make it a smooth, empowering transition.

🏠 Why Do People Downsize?

Downsizing isn’t just about moving into a smaller space—it’s about aligning your lifestyle with your current needs. Common reasons include:

- Retirement and reduced income

- Empty nest after children move out

- Desire for lower maintenance and utility costs

- A shift toward minimalism or simpler living

- Moving closer to family or healthcare

- Selling luxury and/or second homes

🧭 Step-by-Step: How to Downsize Without the Stress

1. Start Early, Start Small

Begin the process months in advance. Start with one room or category (like clothes or books) to build momentum.

2. Sort with Purpose

Use the Four-Box Method: Keep, Donate, Sell, Trash. Be honest about what you use and love.

3. Measure Your New Space

Know the square footage and layout of your future home. This helps you decide what furniture and items will realistically fit.

4. Digitize Where You Can

Scan important documents and photos. This reduces clutter and preserves memories.

5. Sell or Donate Smartly

Use platforms like Facebook Marketplace, OfferUp, or local consignment shops. Donate to charities that offer pickup services.

6. Hire Help if Needed

Consider a senior move manager, professional organizer, or real estate agent who specializes in downsizing.

💡 Tips for a Smooth Transition

- Focus on what you’re gaining, not losing—less stress, lower costs, more freedom.

- Involve family in the process, especially when parting with sentimental items.

- Create a floor plan for your new space to visualize where things will go.

- Celebrate the milestone—downsizing is a fresh start!

📦 Downsizing Isn’t About Less—It’s About More of What Matters

At its core, downsizing is about intentional living. It’s a chance to redefine your space, your priorities, and your future. Whether you’re moving to a cozy condo, a retirement community, or a charming cottage, the process can be empowering and freeing—with the right mindset and support.

Regardless of why you are thinking of downsizing, let’s chat and get you started towards your goal. Let’s connect…

I’m here to help you make the most of your home sale—from smart pricing strategies to positioning your home so it stands out in today’s market. I’ll guide you through what buyers are really looking for, and how to stage your home using cost-effective updates, paint colors, and design touches that deliver the best return on investment.

Need help understanding your home equity or navigating the mortgage process? I’ve got you covered there too. I’ll also keep you up to date with real-time local market trends, pricing data, and buyer demand so you can make confident decisions. Most importantly, I’ll walk you through the entire process, helping you avoid common mistakes and legal pitfalls along the way.

What Does The Case-Shiller Home Price Index Tell Us

The Case-Shiller Home Price Index is a widely respected measure of U.S. residential real estate prices. It provides insights into home price trends across different metropolitan areas and is often used to gauge (indicator) the health and trends of the housing market. This Index tracks changes in residential real estate values across major US metropolitan areas. It is known for its ability to capture both overall price movements and regional variations. The index has shown significant fluctuations throughout its history, including periods of rapid price appreciation and subsequent declines, particularly during the housing bubble of the mid-2000s.

🏠 Some Key Insights from the Case-Shiller Index are as follows:

Home Price Trends Over Time

It tracks changes in the price of single-family homes over time, showing whether prices are rising or falling in specific regions or nationally.

Market Comparisons

The index includes several regional indices (like for Boston, New York, San Francisco, etc.) and a national index, allowing comparisons between local and national housing markets.

Repeat Sales Methodology

It uses a repeat sales approach, comparing the prices of the same property over time to eliminate distortions from different property types or quality levels.

Economic Indicators

Economists and policymakers use it to assess housing market strength, consumer wealth, and potential inflationary pressures.

Investor Sentiment

Real estate investors and analysts use it to identify market cycles and make informed decisions about buying or selling property.

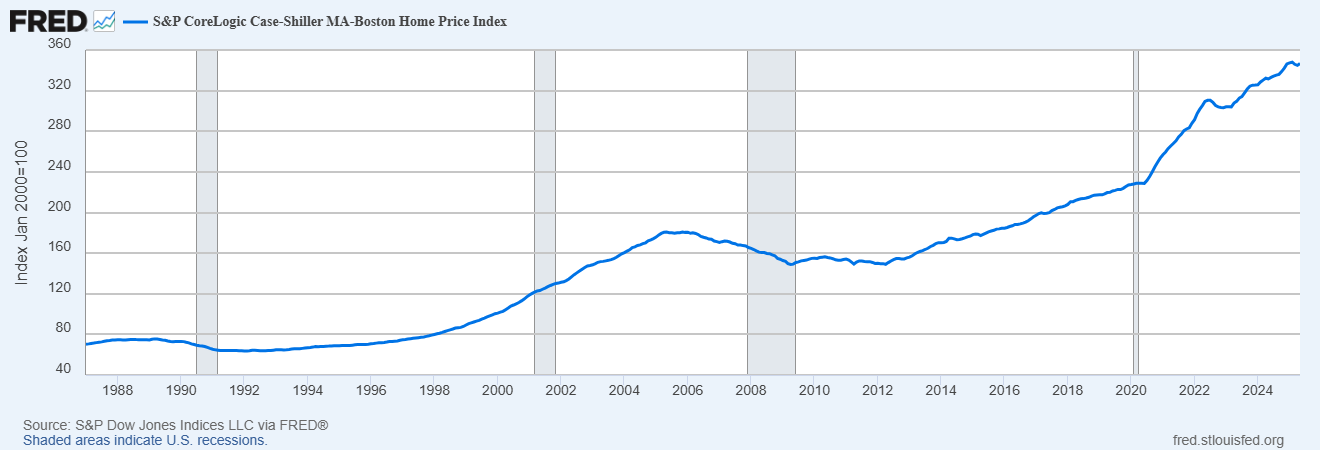

Quik focus on the Boston housing market using the latest Case-Shiller Home Price Index and July 2025 trends:

🏡 Boston Housing Market Update – July 2025

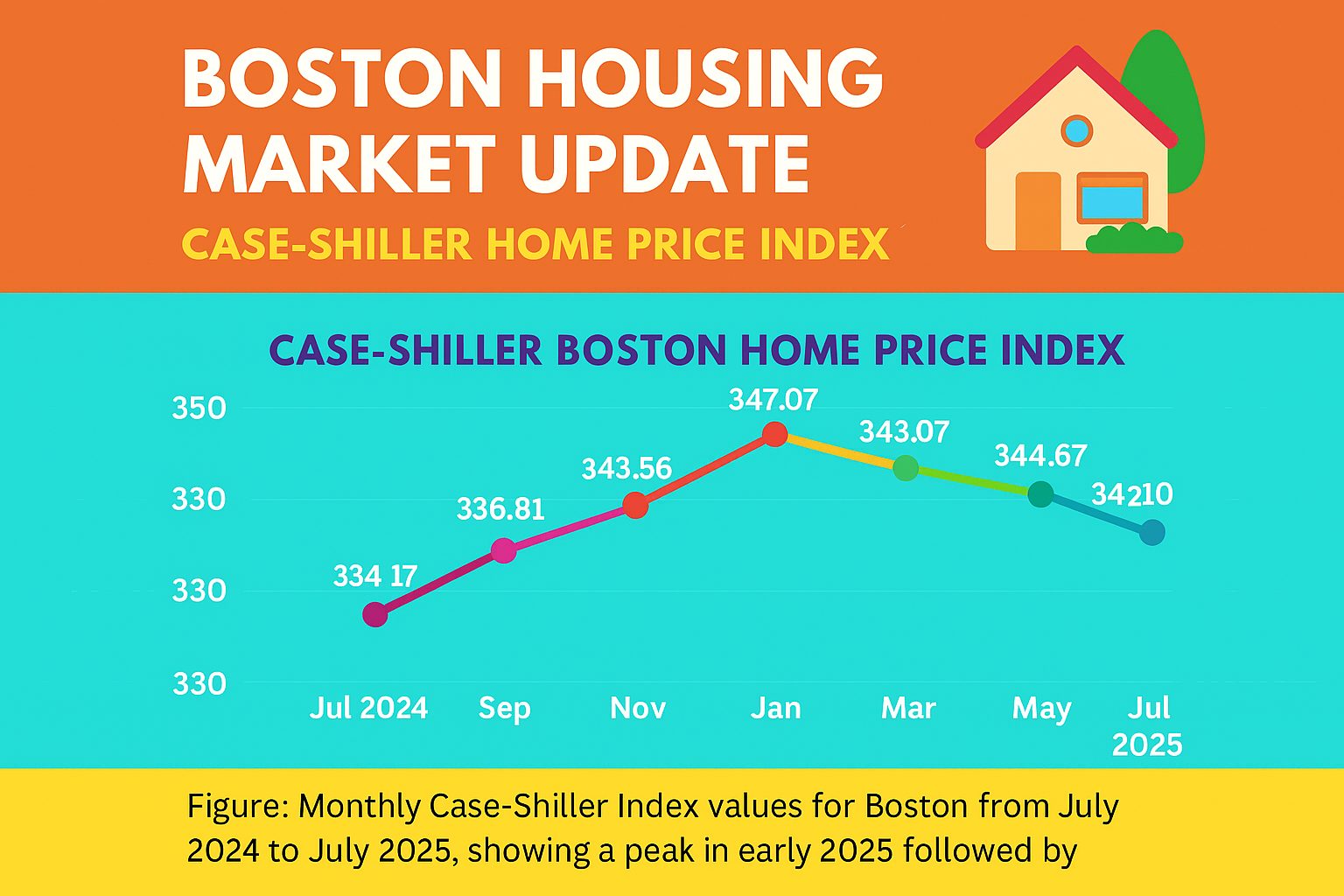

📈 Case-Shiller Index Snapshot

As of April 2025, the S&P CoreLogic Case-Shiller Boston Home Price Index stood at 344.67, marking a modest decline from its peak of 347.94 in February 2025

1.https://fred.stlouisfed.org/series/BOXRSA

This index, which tracks repeat sales of single-family homes, suggests that home price growth in Boston has slowed, reflecting broader national trends.

🔍 What This Means for Boston

Prices are stabilizing after a rapid post-pandemic rise.

The slight dip in the index may signal a more balanced market, offering opportunities for buyers who were previously priced out.

Compared to July 2024 (Index: 334.17), prices are still up year-over-year, but the pace of growth has clearly moderated

2. https://ycharts.com/indicators/case_shiller_home_price_index_boston

🏘️ July 2025 Housing Trends in Boston & Beyond

According to Realtor.com’s July 2025 report, the national housing market is rebalancing, and Boston is part of this shift

3. https://www.realtor.com/research/july-2025-data/

📊 Inventory & Listings

Inventory is up nationwide for the 21st straight month, but Boston’s growth is more modest compared to the South and West.

New listings rose 7.3% year-over-year, though they’ve declined month-over-month since April.

⏳ Time on Market

Homes in Boston are spending more time on the market, with the national median now at 58 days—7 days longer than last year.

This suggests less urgency among buyers, and potentially more room for negotiation.

💰 Pricing Trends

The national median list price is $439,990, up just 0.5% year-over-year.

In the Northeast, prices rose slightly (+0.2%), but Boston’s growth is likely in line with this modest uptick.

Price cuts were reported on 20.6% of listings, indicating sellers are adjusting expectations.

🧠 What Buyers & Sellers Should Know

For Buyers:

More choices and slower price growth make this a good time to explore options.

Be prepared for longer negotiations and less competition than in recent years.

For Sellers:

Pricing strategically is key—overpricing may lead to longer time on market.

Consider staging and incentives to stand out in a more balanced environment.

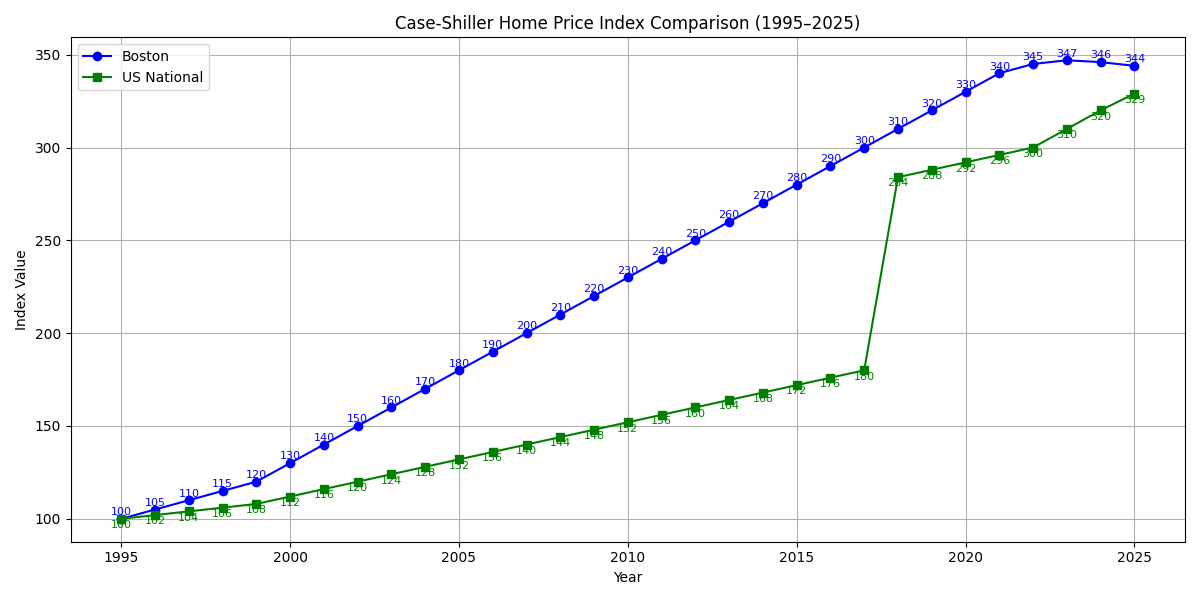

Comparison of Boston area vs US for the last 30 years.

Clearly Boston has outpaced over the past three decades; Boston has proven to be a resilient and appreciating market, outperforming national averages.

Highlights:

Blue line: Boston Index, peaking at 347 in early 2025.

Green line: US National Index, peaking at 329 in early 2025.

A close up for the last year for Boston area

Whether you’re planning to buy, sell, or invest, staying informed with long-term data can help you make smarter decisions. Let’s connect.

Latest Design Trends in Real Estate: What’s Defining Homes in 2025

🏡 The real estate world is buzzing with innovation, and 2025 is shaping up to be a year of style, sustainability, and smart living. Whether you’re a homeowner, investor, or design enthusiast, these trends are transforming how we think about space, comfort, and value.

🌱 1. Sustainable and Eco-Friendly Design

Eco-conscious living is no longer a niche — it’s a must-have. Homes are being built and renovated with:

- Smart thermostats and lighting systems

- Solar panels and energy-efficient appliances

- Natural materials like wood, stone, and limestone

These features not only reduce environmental impact but can also boost property value by up to 15%

📱 2. Smart Home Technology

From voice-controlled lighting to health-monitoring systems, smart homes are becoming the norm. Key features include:

- Automated appliances

- Gesture and voice controls

- Security systems with real-time monitoring

- Front Door integrated smart lock handles

By 2026, homes may even adjust lighting and temperature based on occupant behavior

🧑💻 3. Flexible and Multi-Functional Spaces

With remote work and evolving lifestyles, homeowners want spaces that adapt. Popular solutions include:

- Modular furniture

- Sliding bookcases

- Defined zones within open floor plans

These designs maximize usability and property value while maintaining aesthetic appeal

🌿 4. Biophilic Design

Nature is coming indoors. Biophilic design enhances wellness by incorporating:

- Natural light and indoor plants

- Organic materials like wood and stone with a modern flare and minimalist look and feel

- Rounded and arched shapes

- Bold front doors

- Water features for tranquility

- Warmth:Warm tones, warm woods, warm and welcoming spaces

- Better LED lighting with small recessed

This approach creates peaceful, health-focused environments that reduce stress and improve air quality

🛁 5. Spa-Inspired Bathrooms

Bathrooms are evolving into personal wellness retreats. Trending features include:

- Shower rooms and reduced space wet rooms

- Filtered water systems

- Chromotherapy and aromatherapy setups

- Frameless showers

- Woodlook porcelain tiles on shower walls

- Floating Vainties

- High-end shower fixtures

- Rainfall shower heads

- Smart toilets

- Home Sauna

- Specialized Storage for Makeup and Beauty Products

- Better lighting

These upgrades offer luxury and relaxation, even in compact spaces

🍽️ 6. Kitchen Elegance with Natural Touches

Kitchens are embracing warmth and character with:

- English country style cabinetry and Mix of colored cabinets

- Use of backsplashes from porcelains to tiles to limestone

- Porcelain countertops with integrated tech

- Bold and dramatic kitchen islands that make a statement

- Creative presentations of vent hoods includingbuilt in range alcoves

- Multiple Islands and creative shapes of island

- Open use of shelving

- Pocket door cabinetry

- Tile flooring

- Paneled appliances

- Workstation sinks

Expect cozy textures, earthy tones, and hidden appliances for a seamless look

🪵 7. Minimalist and Paneled Aesthetics

Minimalism continues to thrive with:

- Neutral palettes

- Clean lines and functional furniture

- Paneled appliances that blend into cabinetry

This style promotes simplicity, ease of maintenance, and visual harmony

🌞 8. Outdoor Living Spaces

Outdoor areas are becoming extensions of indoor life. Popular features include:

- Outdoor kitchens and large built-in fire pits

- Cozy patios and backyard retreats

- Integrated seating and lighting outdoors

- Multiple decks

These spaces enhance lifestyle and property appeal, especially for entertaining

Final Thoughts

Design trends in 2025 reflect a shift toward intentional living — where homes are not just places to live, but spaces that support wellness, technology, and personal style. Whether you’re renovating or buying, these trends can help you create a home that’s both beautiful and future-ready.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link