🔄 Reverse Migration in Real Estate

In recent years, a surprising trend has emerged in the U.S. housing market:

Reverse migration refers to a shift in population movement that goes against traditional patterns. In real estate, this typically means:

- People moving away from large urban centers or popular Sunbelt states (like Florida, Texas, and California)

- Returning to smaller cities, rural areas, or Northern regions that were previously experiencing population decline and were less populated, often overlooked areas.

- It’s a reversal of the decades-long trend of urbanization and southern migration.

This shift is reshaping real estate markets across the country—and creating new opportunities for buyers, sellers, and investors. However, after the pandemic there has been a trend of some people moving back into states like Massachusetts.

🌍 What’s Driving the Shift? Why Is Reverse Migration Happening?

Several factors are driving this trend:

1. Climate Risks

- Rising insurance costs and frequent natural disasters (wildfires, hurricanes, floods) in coastal and southern states are making these areas less attractive.

- Northern cities like Detroit, Buffalo, and Milwaukee are seeing renewed interest due to lower climate risk

1. https://diversifiedtrust.com/blog/reverse-migration/

2. Affordability

- Skyrocketing home prices in metro areas have pushed buyers to seek more affordable housing in smaller cities and rural towns.

- Reverse migration is helping revitalize housing markets in previously overlooked regions

2. https://realtytimes.com/consumeradvice/item/5837-20080117_reversemigrate

3. Remote Work

- The rise of remote and hybrid work models has freed people from needing to live near job centers.

- Many are choosing locations based on quality of life, space, and cost, rather than proximity to offices

3. https://www.ashianahousing.com/real-estate-blog/reverse-migration-is-it-here-to-stay/

4. Lifestyle Shifts

- Post-pandemic priorities have shifted toward health, space, and community.

- Smaller towns offer lower density, less pollution, and more personalized healthcare access.

🏘️ What Are The Implications And What Does This Mean For Real Estate

For Buyers:

- More options in emerging markets with lower prices and better value.

- Opportunity to invest in up-and-coming areas before demand spikes.

For Sellers:

- Properties in traditionally “slow” markets may now attract new interest.

- Time to reassess pricing and marketing strategies based on shifting demand.

For Investors:

- Reverse migration opens doors to revitalization projects, multifamily housing, and long-term rental opportunities in overlooked regions.

📌 Reverse migration is more than a trend—it’s a reflection of changing values, economic realities, and climate awareness. As people rethink where and how they want to live, the real estate landscape is evolving in exciting ways. Whether you’re buying, selling, or investing, understanding this shift can help you stay ahead of the curve.

How is Massachusetts doing?

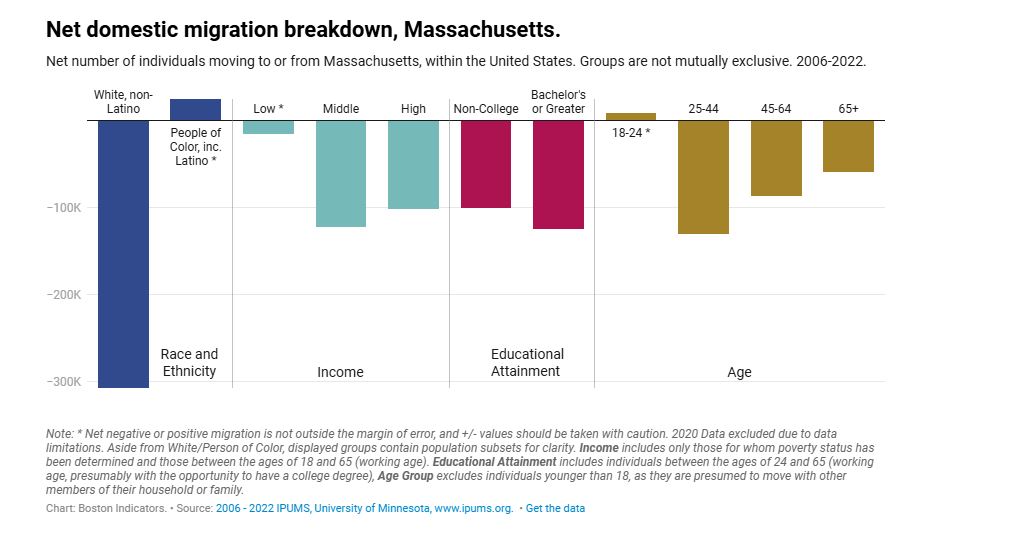

Now let’s change gear to see its impact of the reverse migration phenomenon in Massachusetts—where more residents are leaving the state than moving in.

This phenomenon has had a profound impact on the MA real estate market, especially in terms of housing demand, affordability, and development patterns. Here’s how this trend is reshaping real estate in the state of MA:

🏠 Reverse Migration & Real Estate in Massachusetts

1. Declining Demand in Key Demographics

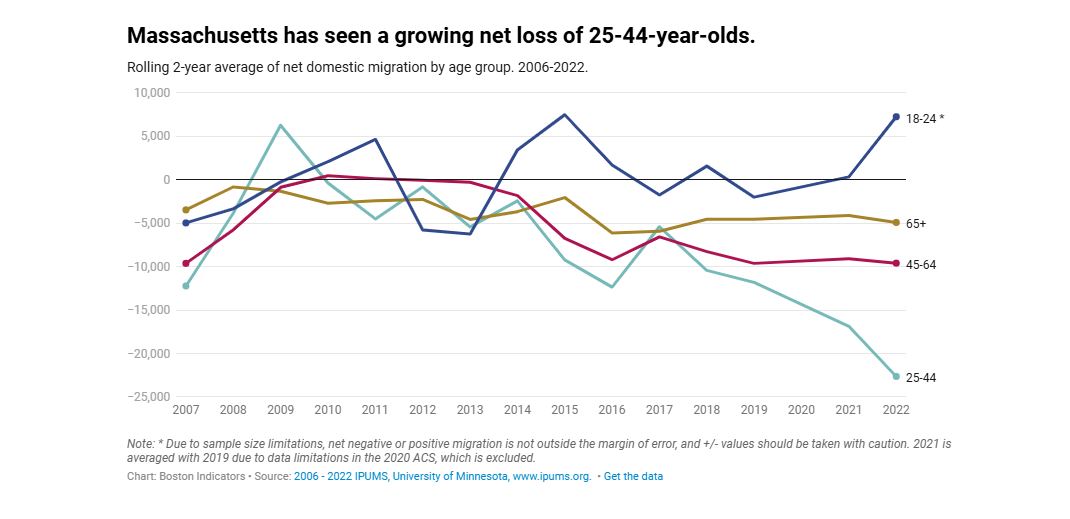

The largest group leaving Massachusetts is young adults aged 25–44, especially those in their family formation years

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

These individuals are typically first-time homebuyers, and their departure reduces demand for starter homes and entry-level housing.

The loss of middle- and high-income earners—who would otherwise be active in the housing market—further weakens demand

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

2. Affordability Crisis Driving Migration

The median income needed to afford a home in Massachusetts is over $162,000, more than twice the average income of young adults. Hence, we see a trend in outmigration for MA – The state is losing young adults in higher numbers of 25–44-year-olds (critical mass age group) leaving than any other age group. This in turn affects Revenue collected by IRS in taxes, an age where they are buying homes, having children, etc. and other impacts.

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

High rental costs and home prices are pushing residents to more affordable states like New Hampshire, Florida, and North Carolina. Even high earners are finding it difficult to buy due to low inventory and high competition, especially in Greater Boston

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

3. Impact on Housing Supply & Development

Developers face challenges in building affordable housing due to zoning restrictions, labor shortages, and rising construction costs.

Despite the passage of Chapter 40Y to promote starter home development, no new zoning districts have been adopted as of mid-2024

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

4. Urban Real Estate & Rental Market Shifts

As young professionals leave, urban rental markets may experience higher vacancy rates, especially in areas dominated by student or young adult housing.

The absence of zoning for non-university student housing in Boston limits options for graduate students and young renters, pushing them out of the city

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

5. Long-Term Economic Risks

The outmigration of working-age residents threatens the future buyer pool, leading to slower home sales and stagnant price growth in some areas.

A shrinking workforce also impacts commercial real estate, as fewer businesses expand or relocate to Massachusetts

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

🔍 Summary

Reverse migration is not just a demographic trend—it’s a real estate disruptor. It reduces demand, strains affordability, and complicates development. Without bold action to expand housing supply and affordability, Massachusetts risks losing the very residents who drive its housing market and economy.

Now let’s see the impact of Reverse migration in Massachusetts on the rental market . This has had a complex impact on rental prices, shaped by both demand shifts and supply constraints. Here’s how:

📉 Demand Pressure from Outmigration

- Young adults (ages 25–44), who make up a large portion of renters, are leaving Massachusetts at record rates

- This demographic shift reduces renter demand, especially in urban areas like Greater Boston, where many of these individuals previously lived.

- A Greater Boston Chamber of Commerce survey found that 83% of young adults cited rent costs as a key factor in deciding whether to stay

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

📈 Supply Constraints Keep Prices High

- Despite falling demand from domestic outmigration, rental prices remain elevated due to:

- Low vacancy rates across both new and older rental units

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

- Insufficient housing construction, especially affordable units.

- Zoning restrictions and lack of student housing options, which push renters into family-oriented units

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

- Low vacancy rates across both new and older rental units

🏙️ Urban Rental Market Dynamics

- In cities like Boston:

- High-income renters still face limited options due to constrained supply.

- Graduate students and young professionals often compete for units not designed for shared living, driving up prices.

- The lack of zoning for non-university student housing further tightens the market

1. https://pioneerinstitute.org/blog/the-housing-crisis-has-a-hand-in-massachusetts-out-migration-trends/

⚖️ Net Effect on Rental Prices

- Short-term: Prices remain high due to supply shortages, even as some demand declines.

- Long-term: If outmigration continues and housing supply improves, rental prices may stabilize or decline, especially in areas losing population.

- However, international immigration and low-income housing demand may offset domestic losses, keeping rental markets competitive

2. https://www.bostonindicators.org/article-pages/2024/april/domestic-migration

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link