New Housing Trends in Real Estate: What Buyers Want in 2025

🏡 The real estate market is evolving rapidly, and today’s buyers are looking for more than just a place to live — they’re seeking homes that reflect their lifestyle, values, and future goals. Whether you’re a homeowner, investor, or agent, understanding these trends can help you stay ahead of the curve.

🌱 1. Sustainable and Eco-Friendly Design

Green living is no longer a niche — it’s mainstream. Buyers are prioritizing:

- Solar panels

- Energy-efficient appliances

- Smart thermostats

- Eco-conscious building materials

Homes that reduce environmental impact and utility costs are in high demand.

🧑💻 2. Remote Work-Ready Spaces

With remote and hybrid work becoming the norm, buyers want:

- Dedicated home offices

- Quiet zones for productivity

- Reliable internet infrastructure

- Flexible layouts for work-life balance

This trend is reshaping suburban and rural markets as people seek space and serenity.

📱 3. Smart Home Technology

Tech integration is a top priority. Popular features include:

- Voice-controlled lighting and security

- Smart kitchen appliances

- Automated climate control

- App-based home management

Convenience, safety, and energy savings are driving this shift.

🏘️ 4. Mixed-Use and Walkable Communities

Buyers are drawn to neighborhoods that offer:

- Walkability

- Local shops and cafes

- Access to parks and fitness centers

- Community events and amenities

Lifestyle-focused living is redefining location preferences.

🏠 5. Customization and Modular Living

Flexibility is key. Homeowners are embracing:

- Modular and prefabricated homes

- Multi-use rooms

- Personalized design elements

- Quick-build options

These homes offer affordability, speed, and style.

💡 Final Thoughts

Real estate in 2025 is all about lifestyle alignment. Buyers want homes that support their health, work, values, and community. Whether you’re renovating, selling, or investing, tapping into these trends I can help you connect and meet your goals with today’s market.

Lifestyle Trends Shaping Today’s Real Estate Market

🏡 Lifestyle Trends

In today’s dynamic housing market, buyers are no longer just looking for large square footage and curb appeal — they’re seeking homes that align with their lifestyle values. From wellness-focused spaces to tech-integrated living, here are the top lifestyle trends influencing real estate decisions in 2025.

🌿 1. Wellness-Centric Living

Homebuyers are prioritizing mental and physical well-being. This includes:

- Spa-like bathrooms

- Natural light and ventilation

- Home gyms and meditation rooms

- Non-toxic and environment friendly sustainable building materials

Properties that promote health and relaxation are gaining traction, especially among millennial and Gen Z buyers.

🧑💻 2. Work-from-Home Optimization

Remote and hybrid work models are here to stay. Buyers want:

- Dedicated home offices

- Soundproofing

- High-speed internet infrastructure

- Flexible spaces that can double as work zones

Homes that support productivity and comfort are commanding premium interest.

🌍 3. Sustainability and Eco-Conscious Design

Eco-friendly features are no longer optional — they’re expected. Popular upgrades include:

- Energy-efficient appliances

- Smart thermostats

- Rainwater harvesting systems

- Solar panels

Green homes not only reduce utility costs but also appeal to environmentally conscious buyers.

📱 4. Smart Home Technology

Tech-savvy buyers are drawn to homes with integrated systems like:

- Voice-controlled lighting and security

- Smart kitchen appliances

- Automated climate control

- App-based home management

Convenience, safety, and efficiency are driving this trend.

🏘️ 5. Community and Lifestyle Amenities

Location still matters — but now it’s about lifestyle fit. Buyers are looking for:

- Walkable neighborhoods

- Access to parks, trails, and fitness centers

- Cultural and social hubs

- Pet-friendly communities

Developments that offer a sense of belonging and enrichment are in high demand.

Real estate is evolving from a transactional experience to a lifestyle investment. Whether you’re buying, selling, or renovating, aligning with these trends can help you stay ahead in a competitive market. Let me know, how I can help. Let’s connect.

Top 6 tips For A Successful Bathroom Renovation

Regardless of whether you are updating, rennovating, or remodeling – consider making upgrades for style and functionality because it will help for increasing your resale value.

Let Design Lead Vital, Efficient and Innovative Spaces

Acronym to help you – DEVILS: Durability-Efficiency-Ventilation-Illumination-Layout-Storage

- D – Durability: Choose long-lasting, water-resistant materials.

- E – Efficiency: Help support sustainability and the environment.

- V – Ventilation: Prevent moisture damage and mold.

- I – Illumination: Layer ambient, task, and accent lighting.

- L – Layout: Plan the space for flow and functionality.

- S – Storage: Smart solutions to keep things tidy and accessible.

🛁 1. Plan Your Layout Wisely

- Maximize space: Consider the flow and placement of fixtures.

- Avoid moving plumbing unless necessary — it can be costly.

- Leverage various vendor tools or apps to visualize the layout before committing.

🎨 2. Choose Durable, Water-Resistant Materials

- Opt for porcelain tiles or ceramic which are beautiful and rich in color and glaze (but some cannot be used inside the shower), quartz countertops, and moisture-resistant paint.

- Consider vinyl flooring for budget-friendly waterproofing.

- Use grout sealant to prevent mold and staining.

💡 3. Illuminate by Upgrading Lighting Strategically

- Combine ambient, task, and accent lighting.

- Add dimmable lights or mirror lighting for a spa-like feel.

- Good illumination enhances both aesthetics and functionality.

- Combine natural light, task lighting (like around mirrors), and ambient lighting.

- Consider dimmable lights for a relaxing spa-like atmosphere.

🚿 4. Focus on Ventilation

- Install a high-quality exhaust fan to prevent mold and mildew.

- Consider a humidity-sensing fan for automatic control.

- Ensure windows can open if possible.

🧼 5. Add Smart Storage Solutions

- Use floating shelves, recessed niches, or vanity drawers.

- Consider over-the-toilet cabinets or mirror cabinets.

- Keep clutter off counters for a clean, modern look.

- Use innovative features to enhance comfort and functionality

- Examples: smart mirrors, touchless faucets, heated floors, or voice-activated lighting.

- These upgrades can modernize your space and improve daily routines.

🛠️ 6. Choose Efficiency in Products and Features

- Design your bathroom to maximize water and energy efficiency.

- Use low-flow toilets and water-saving faucets.

- Use LEDs for lighting and energy efficiency.

- This not only reduces utility bills but also supports sustainability and the environment.

Quick Tips for Buying and Selling Real Estate: Education That Empowers

🏡 Navigating the real estate market can feel overwhelming—but with the right education, you can make confident, informed decisions whether you’re buying or selling. Here are 10 quick tips to help you stay ahead:

🔍 1. Research the Market

Understand current trends—know if it’s a buyer’s or seller’s market to shape your strategy.

💳 2. Get Pre-Approved

Buyers should get pre-approved for a mortgage to clarify budget and show sellers you’re serious. I always recommend understanding the most that you can buy even if you choose not to go with that budget. Remember, your salaries will be going up in case you are just a little apart from the budget you are comfortabel to be at.

🧑💼 3. Hire a Professional REALTOR®

A licensed REALTOR® has access to exclusive market data, industry insights, and relationships with lenders, inspectors, and contractors. These connections help streamline the process and give you an edge in negotiations—whether you’re buying or selling.

📊 4. Know Property Value

Use comparative market analysis to assess fair pricing and investment potential.

🛠 5. Inspect Thoroughly

Always conduct inspections to uncover hidden issues before closing.

🤝 6. Negotiate Smart

Effective negotiation can save money or boost profits—don’t skip this step. I get asked all the time, I can negotiate myself, I do not need an agent to do that. Remember, as a realtor, we have access to a lot of information and insight that you may not, and also remember we have many standing relationships in the industry that can help shape the outcome.

📑 7. Understand Legalities

Stay informed about contracts, disclosures, and local regulations to avoid legal pitfalls.

📈 8. Think Long-Term

Consider future appreciation and rental income potential when evaluating properties.

💰 9. Budget Beyond the Price

Account for closing costs, taxes, maintenance, and unexpected expenses.

🎓 10. Keep Learning

Real estate evolves—stay sharp with courses, seminars, and industry news. Work with me, and Ill share neigborhood newsletters and reports and keep you abreast.

Empower your decisions with education and pick a realtor that spends time educating you through out the process.

💡 Why Work with Me?

With a background in sales and a deep understanding of the Massachusetts market, I bring a strategic, client-first approach to every transaction. I’ve built strong relationships across the industry—from mortgage brokers to contractors—which means I can help you move faster, negotiate smarter, and avoid costly pitfalls. Whether you’re investing, downsizing, or buying your first home, I’m here to guide you every step of the way and every step of your real estate journey. Let’s connect.

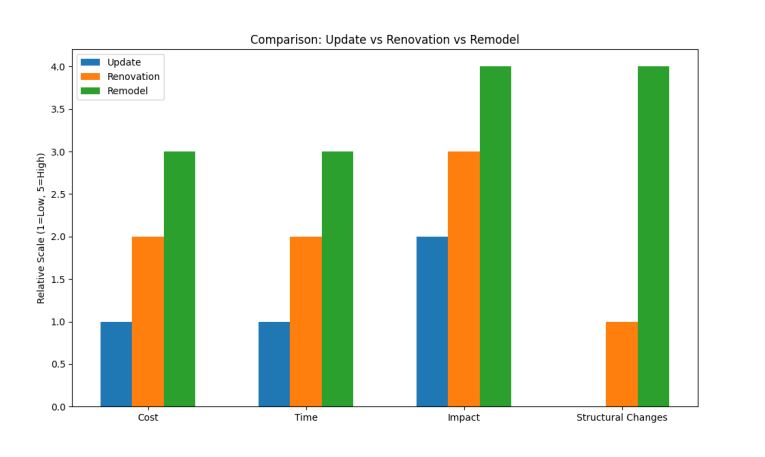

Renovation vs. Remodel vs. Update

🛠 Renovation vs. Remodel vs. Update: What’s the Difference?

These words are often used interchangeably, renovation and remodeling have distinct meanings. Remodeling involves significant changes to the purpose and layout of a space, while renovation focuses on repairing and improving the existing structure. For example, converting a bedroom into a bathroom is a remodel, while updating the fixtures and finishes in an existing bathroom is a renovation.

-

Renovation

- Definition: Restoring or updating an existing space without changing its structure.

- Examples: Repainting walls, replacing flooring, updating cabinets or fixtures.

- Goal: Refresh and modernize while keeping the original layout intact.

- Cost: Generally less expensive than remodeling.

- Ideal For: Cosmetic upgrades, rental property improvements, or prepping a home for sale.

-

-

Reasons for Renovations:

-

-

-

- Increased functionality and comfort:Making spaces more usable and enjoyable.

- Enhanced aesthetics and style:Updating the look and feel of a space to reflect personal preferences.

- Increased property value:Adding features that appeal to potential buyers and increase the home’s market value.

- Addressing wear and tear:Repairing damaged or outdated features.

- Energy efficiency improvements:Upgrading to more efficient appliances and insulation.

- Adapting to changing needs:Making spaces more suitable for growing families or changing lifestyles.

- Increased functionality and comfort:Making spaces more usable and enjoyable.

-

-

Remodel

- Definition: Changing the structure, layout, or purpose of a space.

- Examples: Removing walls to create an open floor plan, converting a garage into a living space, or adding a bathroom.

- Goal: Transform how a space functions.

- Cost: Typically more expensive due to structural changes and permits.

- Ideal For: Long-term value increases, custom living needs, or major property repositioning.

-

Update

-

- Definition: Making small, often cosmetic changes to modernize a space.

- Focus: Quick improvements that enhance style or function.

- Examples:

- Swapping out light fixtures

- Changing cabinet hardware

- Adding smart home features

- Goal: Keeping the space current without major work or expense.

Which One Should You Choose when Investing Or Retiring?

- Investors:

- Updates are great for quick value boosts before listing or renting.

- Renovations can increase appeal and rental income.

- Remodels may be worth it for flipping or repositioning a property.

- Retirees:

- Updates and renovations help maintain comfort and style.

- Remodels can adapt a home for aging in place (e.g., wider doorways, walk-in showers).

Here’s a guide to help you decide when to choose renovation, remodel, or update, depending on your goals, budget, and property type:

🏡 When to Choose Renovation, Remodel, or Update

✅ Choose an Update When:

- You want quick, low-cost improvements.

- The goal is to refresh the look without major work.

- You’re preparing a home for sale or rent and want to boost appeal.

- Examples:

- Swapping outdated light fixtures

- Replacing cabinet hardware

- Adding a smart thermostat

Best for: Budget-conscious investors, staging for resale, or modernizing a rental unit.

🔨 Choose a Renovation When:

- The layout works, but the space feels worn or outdated.

- You want to increase property value without major structural changes.

- You’re improving functionality and aesthetics.

- Examples:

- Replacing flooring or countertops

- Updating bathrooms or kitchens

- Repairing drywall or repainting

Best for: Mid-range upgrades, long-term rentals, or refreshing a home for retirement.

🏗️ Choose a Remodel When:

- You need to change how a space functions.

- You’re dealing with structural issues or want to reconfigure the layout.

- You’re planning a major transformation (e.g., open concept, additions).

- Examples:

- Converting a garage into a living space

- Expanding a kitchen or adding a bathroom

- Creating an in-law suite or rental unit

Best for: Flipping homes, adapting for aging in place, or maximizing ROI in high-value markets.

NOTE: When planning above, please keep in mind what permits are required by your city/town in your state.

🏗️ Remodeling Permits in Massachusetts: What You Need to Know

🔍 When Are Permits Required?

In Massachusetts, most remodeling projects require permits, especially if they involve:

- Structural changes (e.g., removing or adding walls)

- Electrical work

- Plumbing work

- HVAC installations

- Additions or expansions

- Window or door replacements (if altering size or structure)

Even if you the home owner are doing the work yourself, you must apply for the permit through your local building department. If you hire a contractor, they are responsible for obtaining the necessary permits.

🧾 Types of Permits

- Building Permit

Required for structural changes, additions, and major renovations. - Electrical Permit

Must be obtained by a licensed electrician for any electrical work beyond minor repairs. - Plumbing Permit

Required for new installations or major plumbing changes. Only licensed plumbers can apply. - Mechanical Permit

Needed for HVAC system installations or modifications.

🏛️ Where to Apply

Permits are issued by your local municipal building department. Many towns offer online applications for minor work, but larger projects may require in-person submission with detailed building plans.

⚠️ Why Permits Matter

- Legal Compliance: Avoid fines and project shutdowns.

- Safety: Ensures work meets building codes.

- Resale Value: Unpermitted work can complicate future sales or refinancing.

- Insurance: Claims may be denied if work was done without proper permits.

🛑 What Doesn’t Require a Permit?

Minor repairs like:

- Painting

- Replacing fixtures (without altering plumbing/electrical)

- Flooring updates

Always check with your local building inspector to confirm.

The timeline for obtaining remodeling permits in Massachusetts can vary depending on the scope of the project, municipality, and completeness of your application, Fro reference, here is a general breakdown to help you get started.

🗓️ Typical Permit Timeline for Remodeling in Massachusetts

1. Preparation (1–2 weeks)

- Design & Planning: Finalize your remodeling plans with an architect or contractor.

- Documentation: Gather required documents like site plans, construction drawings, and contractor licenses.

2. Application Submission (1–3 days)

- Submit your permit application to your local building department (online or in person).

- Some towns offer short-form permits for minor work, which can be processed faster.

3. Review Process (1–4 weeks)

- The building department reviews your plans for code compliance.

- Simple renovations (e.g., interior updates) may be approved in a few days.

- Complex remodels (e.g., structural changes, additions) may take several weeks, especially if multiple departments (zoning, fire, health) are involved.

4. Permit Issuance

- Once approved, you’ll receive your permit and can begin work.

- You may need to schedule inspections at various stages of the project.

⏱️ Fast-Track Tips

- Hire a licensed contractor: They often know how to navigate local processes efficiently.

- Submit complete and accurate plans: Incomplete applications are the #1 cause of delays.

- Check local timelines: Each city or town in Massachusetts may have different processing speeds.

Investing in Lifestyle: Top Real Estate Communities for Investors & Retirees in Massachusetts

Massachusetts offers more than just rich history and world-class education—it’s also home to some of the most attractive real estate communities for investors and retirees alike. Whether you’re looking to grow your portfolio or settle into a peaceful, well-connected neighborhood, the Bay State has something for everyone.

Why Massachusetts?

From the scenic coastlines of Cape Cod to the vibrant suburbs of Greater Boston, Massachusetts combines strong property values, high rental demand, and quality of life—making it a smart choice for both long-term investment and retirement living.

Best Communities for Real Estate Investors

- Cambridge

Just across the Charles River from Boston, Cambridge is a magnet for tech professionals, students, and international renters. With relatively low residential property tax rates, high rental demand, and proximity to institutions like Harvard and MIT, it’s a prime location for investors seeking long-term appreciation and stable income. - Worcester

With a growing population and revitalized downtown, Worcester offers affordable entry points and strong rental yields. It’s a hotspot for multi-family investments and student housing. - Lowell

A former mill city turned innovation hub, Lowell is attracting young professionals and renters. Investors benefit from lower prices compared to Boston, with steady appreciation. - Springfield

Known for its affordability and economic development initiatives, Springfield is ideal for investors seeking cash flow and long-term growth.

Top Picks for Retirees

- Cape Cod (Falmouth, Sandwich, Chatham)

With its coastal charm, healthcare access, and active adult communities, Cape Cod is a dream destination for retirees looking for a relaxed lifestyle. - Northampton

A vibrant arts scene, walkable downtown, and access to top-tier medical care make Northampton a favorite among retirees who want culture and convenience. - Lexington & Concord

For those seeking a blend of history, nature, and upscale living, these towns offer peaceful neighborhoods, excellent services, and proximity to Boston.

How can I, GoToZuby Help?

I understand that real estate is more than a transaction—it’s a lifestyle decision. Whether you’re building your investment portfolio or planning your next chapter in retirement, I will help you find the right community with the right opportunities. Let’s connect and explore your options today.

Communities

Discovering the Right Real Estate Community for You

When it comes to buying a home, it’s not just about the property—it’s about the community. Whether you’re a first-time buyer, relocating, or investing, choosing the right neighborhood can make all the difference in your lifestyle and long-term satisfaction.

What Makes a Great Real Estate Community?

A great community offers more than just curb appeal. Here are a few key factors to consider:

- Accessibility: Proximity to highways, public transportation, and major employment hubs.

- Amenities: Parks, schools, shopping centers, and recreational facilities.

- Safety: Low crime rates and active neighborhood watch programs.

- Vibe: Whether you’re looking for a quiet suburban feel or a vibrant urban atmosphere, the community’s culture should match your lifestyle.

Popular Community Types

- Family-Friendly Suburbs

Ideal for growing families, these areas often feature top-rated schools, playgrounds, and a strong sense of community. - Urban Living

Perfect for professionals and creatives, urban communities offer walkability, nightlife, and cultural attractions. - Active Adult Communities

Designed for 55+, these neighborhoods focus on wellness, social activities, and low-maintenance living. - Luxury Enclaves

High-end communities with gated access, custom homes, and exclusive amenities.

How Can I, GoToZuby Help You?

I specialize in matching my clients with communities that fit their goals and lifestyle. Whether you’re looking for a quiet retreat or a bustling neighborhood, my local expertise and personalized approach will help make your search seamless.

Ready to explore your next community?

Let’s find your perfect fit—together.

Quick Basic Math Calculations

Listed below are a few formula calculations to help with some basic real estate related math.

Loan-to-Value Ratio (LTV) Calculation

This ratio is a key measure that lenders use to assess the risk of a loan. The ratio measures the relationship between the “amount borrowed” and the “property’s appraised value”. It’s a key factor that lenders use to assess the risk of a loan. A lower LTV ratio is favorable because it implies that there is “more equity in the property” and thus typically results in more favorable loan terms, i.e., lower interest rates, avoidance of private mortgage insurance (PMI), etc. This is important to have before starting the home search because the LTV helps buyers determine how much they can borrow and at the same time gives insight to sellers about potential financing challengesthat the buyers might face.

Formula: (Appraised Property Value / Mortgage Amount) × 100 = LTV

Example:

- Home purchase price $500,000.

- Buyer has $75,000 available for down payment; Mortgage amount to borrow: 500,000-75,000 = $425,000

- LTV ratio to borrow: ($425,000 / $500,000) × 100 = 85%

A LTV of 80% is typically the highest ratio many lenders will allow without requiring PMI, saving the borrower on additional insurance costs. In this example of 85% it is less than 80% so it gives insight on how the buyer is approximately structuring their financing in purchasing this property.

Percentage Calculation

To help calculate financial projections and decisions for commission rates, return on investments, etc.,

Formula: (Price × Fee percent)

Example :

If your real estate agent takes 5% commission on a propertyselling price of $1,000,000 then the commission fee is calculated as follows:

$1,000,000 x 5% (or .05 in decimal form) = $50,000

- Whole (the sale price) = $1,000,000

- Percentage of Commission = 5%

- Commission fee) = x = $50,000

Simple Interest Calculation

It is calculated for interest earned or paid on a principal amount over a specific period at a fixed interest rate. Simple interest is not compound interest in that interest is not added to the principal at each interest period, thus the interest earned does not increase over time. The purpose of this formula is to show borrowers and/or investors what the cost or earnings from a simple financial transaction (no complexities of compounding)is. It helps provide clarity on the financial decision.

Formula: P (Principal Amount) × IR (Rate of Interest) × T (Time) = IInterest

Example:

For a $1,000 loan at a 6% annual interest rate over five years.

$1,000 × 0.06 × 5 = $150

Principal Amount = $1,000

Rate of Interest = 6% or (0.06 in decimal form)

Time = 5 years

Interest = $300

The calculation shows an interest accrued over five years on a $1,000 loan at a 6% interest rate is $300.

Down Payment Calculation

In order to calculate the initial payment needed to purchase a home, the down payment equation is used. Typically this amount is a percentage of the total sale price, and it reduces the loan amount needed by this calculated amount which in turn affects the borrower’s mortgage payments and interest over time.

Formula: Sale Price × Percentage Payment = Down Payment Amount

Example:

In order to qualify for financing a new home purchase of $800,000, if client puts at least 20% down,

the downpayment calculation = $800,000 × 20% (or 0.20 in decimal form) = $160,000

Thus the downpayment is $160,000 on a $800,000 house which impacts the buyer’s mortgage requirements, but lowers the loan amount to $640,000 ($800,000-$160,000) and potentially qualifies the buyer for better interest rates.

Closing Costs Calculation

In order to best prepare for the financial transaction it is important to plan and understand for closing costs which typically include: appraisal, title insurance, legal, and prepaid items.

Formula: Purchase Price × % of Closing Costs = Closing Costs

Example:

The closing costs typically range from 2% to 5% of the home’s purchase price.

If purchase price is $800,000 and closing costs percentage is 5 % of the purchase price

$800,000 × 4% = $32,000

The buyer should be prepared to budget and come up with approximately $32,000 in closing costs in addition to the home’s purchase price.

Price per Square Foot (ppSft) Calculation

Ppsqft is used to assess a property’s value by breaking down its price in relation to its size. This metric used for property value comparison to get at competitive pricing and provide a solid basis for negotiation.

Formula: Sale Price of the Property / Total Square Footage = Price per Square Foot

Example:

House sold price of $800,000 and has 2,500 square feet of living space.

$800,000 / 2,500 sq ft = $320 price per sq ft

This calculation is indicative the property costs $320 for every square foot of space. It helps make it easy to compar itse value with other homes in the areas based on their sizes and sale prices.

Affordability Calculation

This calculation is used to determine and estimate the maximum mortgage amount that the buyer can spend for buying a home. It typically takes into account the buyer’s income, debt, and current interest rates.

Formula: (Gross Monthly Income × Affordability Ratio) – Total Monthly Debt Payments

= Maximum Affordable Mortgage

Example: At a gross monthly income of $6,000, with monthly debt payments of $1,000, and the lender’s qualifying ratio suggests that housing expenses should not exceed 28% or .28 in decimal form (affordability ratio) of the monthly income.

($7,000 × 28%) – $1,000 = $960

This $960 is the number used to figure what the buyer can focus on purchasing a property for within an appropriate price range.

Cash Flow Calculation

Investors use this formula to help them determine the “net income” generated from an” investment property” after all operating expenses and mortgage payments have been deducted. The goal of this metric is to assess whether a property will provide a positive income stream and justify their investment. A positive cash flow is indicative that a property will generate more income than the cost to maintain and operate it and a negative cash flow is indicative that the investmentmost likely may not be financially viable in its current state.

Formula: Monthly Rental Income – Monthly Expenses = Monthly Cash Flow

Example:

When considering a property that generates $5,000 in monthly rental income. The property’s monthly expenses, including mortgage, insurance, taxes, and maintenance, total $4,000.

$5,000 monthly rental income – $4,000 monthly expenses = $1,000 monthly cash flow – Positive flow – indicating a profitable investment opportunity.

Return On Investment (ROI) Calculation

It is a critical metric for Investors that helps them measure and calculate the percentage return on an investment relative to its cost, when evaluating the profitability of real estate transaction. ROI helps understand the gain or loss generated (or potential) on a property compared to the initial investment: inclusive of all costs, purchase price, renovation expenses, and selling costs.

Formula: (Net Profit / Total Investment Cost) × 100 = ROI OR [(Selling Price – Total Investment Cost) / Total Investment Cost] × 100 = ROI

Both of the above equations are the same since Net Profit = Selling Price – Total Investment

Example:

Purchase Price $300,000, Rennovation costs $20,000

Total Investment Cost = $320,000 ($300,000 + $20,000)

Selling Price = $450,000

[($320,000 – $450,000) / $450,000] × 100 = 29%

ROI = 29%

This ROI signifies a profitable and effective use of the investor’s capital utilization.

Net Operating Income (NOI) Calculation

NOI helps assess a property’s profitability and potential cash flow and measures the “annual income” generated by a property after “operating expenses” have been subtracted but before “deducting taxes and financing costs”.

Formula: Gross Rental Income – Operating Expenses = NOI

Example:

Rental property generates annual rental income of $90,000.

Annual operating expenses (maintenance, insurance, property management fees, etc.) are $30,000.

NOI =$90,000 – $30,000 = $60,000

A positive NOI of $60,000 is significant and it means that this property is generating sufficient income to cover operating expenses – key factor for long-term investment sustainability. This metric results is signifiing a strong income-producing capability (before financing or taxes).

Capitalization Rate (cap rate) Calculation

The cap rate, is used to estimate the potential return on an income-producing property, independent of financing. This metric provides a snapshot of the property’s operational performance and is derived by comparing the NOI to its current market value. This ratio is used when evaluating the ROI for different properties and helps facilitate comparisons across the market.

Formula: (NOI / Current Market Value) × 100 = Cap Rate

Example:

Current Market Value = $750,000. NOI is $15,000

cap rate = ($80,000 / $750,000) × 100 = 10.7%

A cap rate of 10.7% indicates a potentially attractive investment opportunity, assuming it aligns with the investor’s risk tolerance and investment criteria.

Break-even Ratio (BER) Calculation

This BER metric calculation helps assess investment properties’ financial stability and risk, as well as helps to understand the minimum occupancy rate needed to ensure that a rental property’s income covers its operating expenses.

Formula: (Total Operating Expenses / Gross Potential Income) × 100 = BER

Example:

Property price $1,000,000, renovations $200,000, annual gross potential rental income $150,000, fully occupied, with annual operating expenses$80,000.

BER = ($80,000 / $150,000) × 100 = 53.3%

53% occupancy rate is needed to cover the operating expenses, it also demonstrates the level of financial risk and the occupancy threshold that is required to avoid losses on the investment.

Debt Service Coverage Ratio (DSCR) Calculation

DSCR ratio evaluates the risk of lending to or investing in a property. It measures a property’s ability to cover its debt payments with its income. A DSCR greater than one is desired and indicates that the property is generating enough income to cover its debt obligations, reducing the risk of default. Lenders typically look for a DSCR above a certain threshold to ensure an adequate cushion to absorb any unforeseen declines in income.

Formula: NOI / Total Debt Service = DSCR

Example:

$50,000 NOI on a rental property with annual mortgage payments of $35,000.

$50,000 / $35,000 = 1.43

NOI = $50,000

Total Debt Service = $35,000

DSCR = 1.43

A DSCR of 1.43 means that the property generates 43% more income than needed to cover the debt service, which indicates that it is a good financial health and a low risk of default.

After Repair Value (ARV) Calculation

The ARV is a key projection concept and metric in real estate investing for those involved in house flipping or property renovation. It focuses on the estimated value of a property’s value after it has been improved or renovated -after all repairs, renovations, or improvements have been completed. This metric allows buyers or investors engaged in flipping or rehabbing properties to estimate the future selling price and potential profit. Understanding how to calculate and accurately estimate ARV allows to make informed decisions about the feasibility and profitability of a renovation project, ensuring that the costs of repairs do not exceed the value added.

So why does ARV Matter? It helps with:

Investment Decisions: Helps investors determine if a property is worth buying and fixing.

Loan Calculations: Lenders often use ARV to decide how much money to lend for rehab projects.

Profit Estimation: ARV is used to calculate potential profit margins.

How to Calculate ARV?

Formula: ARV =Property’s Purchase Price + Value of Renovations = ARV

First, find Comparable Properties (Comps) at recently sold homes in the same area to determine the purchase price

Ensure they are similar in size, style, and condition to the expected post-renovation state.

Then, get the Average the Sale Prices of Comps. To do that use 3–5 best comparable properties because the average gives a solid estimate of the ARV.

Example:

If similar renovated homes in the area sell for:

$450,000

$460,000

$440,000

Then the ARV for purchase price would be:

ARV for rennovated selling price=(450,000+460,000+440,000)/3=$450,000

Calculation

Property’s Purchase Price should be below selling price

If purchased for $400,000, Rennovations Value = $50,000

Selling Price should exceed this ARV of $450,000 amount to make profit since after the necessary repairs and improvements of $50,000, and based on a comparative market analysis, the expected selling price should be >$450,000 but may not be. Since the market analysis predicts a selling price of $450,000, the project at 450,000 is not profitable but if sells for $500,000 it could result in a substantial profit. Thus, these calculations and metrics are essential for assessing properties and providing a framework for it. Based on the above scenario the investor should target less than $40o,000 for a purchase price to make profit. After Repair Value (ARV) is key in calculating value.

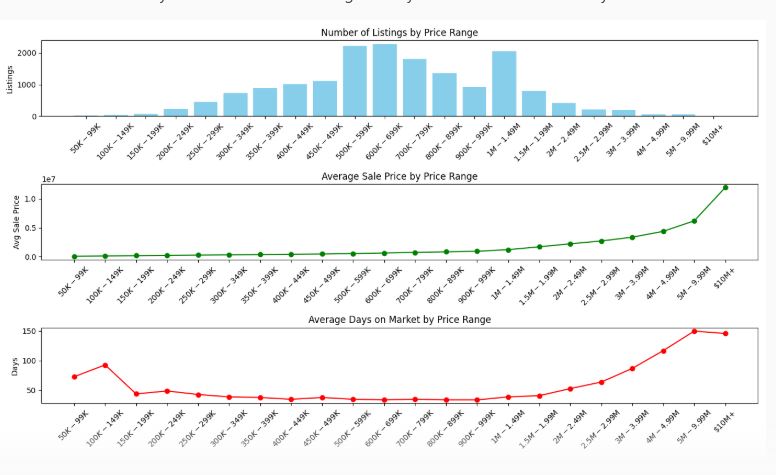

A Tale of Two Halves (Jan–Jun 2025)

🏡 Massachusetts Real Estate Market

In the first half of 2025, the Massachusetts single-family housing market painted a vivid picture of strong demand, rising prices, and swift sales. With 16,933 homes sold, the market moved at a brisk pace, averaging just 39 days on the market and 27 days to receive an offer.

📈 The Heart of the Market

The sweet spot for buyers and sellers was between $500,000 and $999,999, where over 8,700 homes changed hands. Homes in this range sold quickly—often within 23 to 26 days—and frequently above asking price, with sale-to-list price ratios hovering around 102–103%.

💰 Luxury Moves Slowly

At the top end, the luxury market (homes priced $3M and above) saw fewer transactions—just 322 homes—but with much longer timelines. These properties lingered on the market for 87 to 150 days, reflecting a more patient buyer pool. The highest recorded sale reached a staggering $17 million.

🏘️ Affordable but Scarce

On the other end, homes under $200,000 were rare, with only 119 listings in total. These properties took longer to sell and often closed below their original list prices, suggesting limited demand or condition-related challenges.

📊 By the Numbers

- Average Sale Price: $854,781

- Median Price: $669,000

- Total Market Volume: $14.47 billion

- Highest Volume Segment: $500K–$699K range

- Strongest SP:LP Ratio: $700K–$999K range (103%)

- Fastest Sales: $400K–$699K homes (23–25 days to offer)

Great Wealth Transfer

The Great Wealth Transfer refers to the unprecedented intergenerational shift of wealth currently underway, primarily in the United States, but with global implications.

🔍 What Is It?

The Great Wealth Transfer is the largest transfer of wealth in history, as baby boomers and the Silent Generation (those born before 1946) pass down their accumulated assets to younger generations — primarily Gen X, millennials, and Gen Z.

- Estimated total: Over $84 trillion is expected to change hands by 2045.

- Heirs vs. Charity: About $72.6 trillion will go directly to heirs, while nearly $12 trillion is projected to be donated to charities

💰 What’s Being Transferred?

Assets that will be passed down:

- Cashand other liquid assets

- Real estate

- Investment portfolios (stocks, bonds, retirement accounts)

- Businesses and business interests,

- Personal property and heirlooms

🌍 Why does It Matter?

This massive shift has broad economic and social implications – noteworthy are

- Wealth concentration: The top 10% of households will receive the majority of the wealth, with the top 1% holding as much as the bottom 90% 2Wikipedia

- Changing values: Younger generations are more likely to prioritize social responsibility, sustainability, and impact investing, potentially reshaping financial markets 1Money.com

- Economic ripple effects: It could affect housing markets, education, healthcare, and even politics, as wealth influences access and opportunity 2Wikipedia

🧭 How to get ready for it and Prepare better

Since this might affect your own financial planning or inheritance strategy, it is important to prepare better because it involves both financial and emotional planning to ensure a smooth and responsible transition of assets across generations. For both those giving and receiving wealth, preparation is key. Prepare Prepare Prepare

- Estate planning: Wills, trusts, and beneficiary designations are essential.

- Tax strategies: Tools like Roth conversions and step-up in basis rules can minimize tax burdens 3Bankrate

- Financial literacy: Education and planning crucial because many heirs may not be financially prepared for this transfer.

Some quick key steps to prepare beter include list below and ends with a well created and personalized family checklist or template for your family’s wealth transfer plan outlining a basic estate planning roadmap. Start with:

🧭 1. Open Family Conversations 1cnbc.com

- Talk about money early and often: Many families avoid discussing finances, which can lead to confusion or conflict later

- Set expectations: Clarify what heirs can expect to receive and when, and discuss the values you want to pass along with the wealth. Manage well

📜 2. Create or Update Your Estate Plan 1cnbc.com

- Wills and trusts: Ensure you have a valid will and consider trusts to manage how and when assets are distributed. Well documented and in appropriate trusts to avoid probate isues later too.

- Healthcare proxy and power of attorney: These documents are essential in case of incapacity.

- Beneficiary designations: Regularly update update and update these on retirement accounts, insurance policies, and bank accounts

💼 3. Work with Professionals 1cnbc.com

- Financial advisors: Help with investment strategy, tax planning, and wealth preservation.

- Estate attorneys: Draft and review legal documents.

- Accountants: Assist with tax-efficient strategies for gifting and inheritance

🧠 4. Educate the Next Generation

- Financial literacy: Teach heirs about budgeting, investing, taxes, and estate planning. Start early.

- Use a checklist: Evaluate their understanding of key financial concepts and identify areas for improvement 2 hancockwhitney.com

- Family finance meetings: Regularly discuss the family’s financial goals and legacy plans 2 hancockwhitney.com

🧾 5. Plan for Taxes and Legal Changes

- Estate tax exemption: Currently high (nearly $14 million per individual in 2025), but may drop after 2025 unless extended 1cnbc.com

- Gifting strategies: Use annual gift exclusions and lifetime exemptions to reduce taxable estates.

- Prenuptial agreements: Especially important if you want to protect family wealth from marital disputes 3 ubs.com

🧩 6. Customize Based on Heirs’ Readiness

- Tailor strategies: Use trusts or conditional inheritances for heirs who may not be ready to manage large sums.

- Align with values: Some families tie inheritance to education, employment, or charitable involvement 2 hancockwhitney.com

According to USA Today, “Why should people think about inheritance now? The so-called great wealth transfer has begun. Nearly $124 trillion in assets will change hands through 2048, according to estimates by the consulting firm Cerulli Associates. Recipients are expected to inherit some $106 trillion of that amount, mainly from baby boomers, with the rest going to charity.” – https://www.usatoday.com/story/money/personalfinance/2025/06/27/how-disclaim-inheritance-why/84330310007/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link