The upcoming new Massachusetts regulation 830 CMR 62B.2.4 issued by the Massachusetts Department of Revenue (DOR), under M.G.L. c. 62B, § 2, establishes withholding requirements on the sale or transfer of Massachusetts real estate. Basically, the law authorizes the DOR to require withholding of taxes on certain payments, including real estate sales. It targets nonresident Sellers (individuals or entities) without a continuing Massachusetts presence, selling Massachusetts real estate where the gross sales price is $1,000,000 or more. [mass.gov]

The expected effective date applies to real estate closings on or after November 1, 2025.

🔹 Key Requirements

- Withholding At Closing Agent Responsibilities:

- Typically Settlement agents – closing attorney, title company, or escrow agent.

- Must withhold a portion of the sale proceeds (typically 4-5% or more of the gross sale proceeds) and remit it to the MA DOR within 10 days of closing.

- Must file a Form NRW (Nonresident Real Estate Withholding Return), even if no tax is withheld. [stewart.com]

- Electronic Filing: All filings and payments must be submitted via https://www.mass.gov/orgs/massachusetts-department-of-revenue.

- Transferor (Seller) Responsibilities:

- Sellers must complete a Transferor’s Certification form to document residency or exemption status.

- This form documents the seller’s capital gain and exemption status, if applicable. [mass.gov]

- Sellers must complete a Transferor’s Certification form to document residency or exemption status.

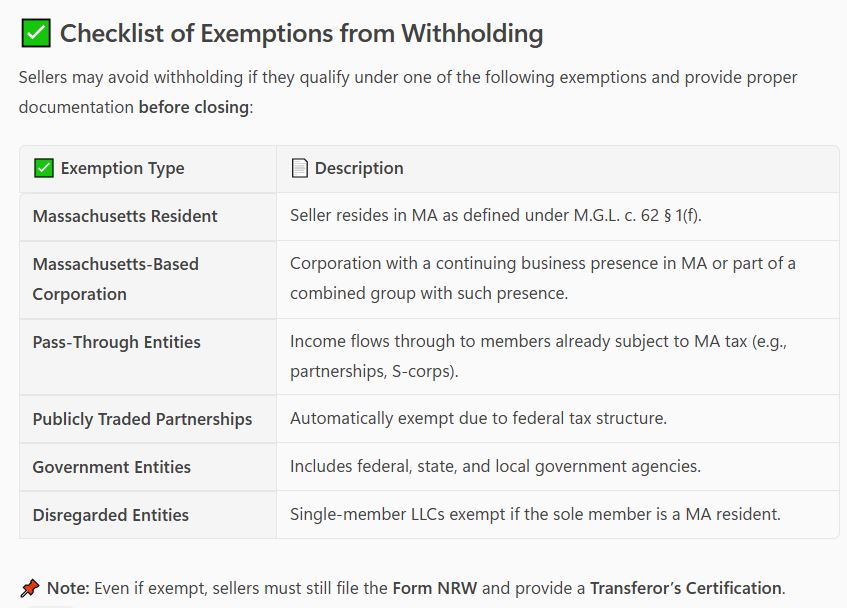

🔹 Exemptions & Exceptions

- Certain sellers may qualify for exemptions from withholding, if they are

- Massachusetts residents (Defined under M.G.L. c. 62 § 1(f) and they must certify residency status on the Transferor’s Certification.)

- Certain types of MA based entities (Corporations with a continuing business presence in the Commonwealth. And, members of a combined group where at least one member has a Massachusetts presence.)

- Pass-Through Entities (Entities whose income flows through to members already subject to MA tax. And includes partnerships and S-corps filing Massachusetts tax returns.)

- Publicly traded partnerships (Automatically exempt due to their tax structure and reporting obligations.)

- Government entities (Includes the Federal government, Massachusetts government, and political subdivisions or agencies.)

- Disregarded entities (e.g., single-member LLCs) whose sole member is a Massachusetts resident. [mass.gov], [virtualund…writer.com], [riw.com] And if the exemption is based on the owner’s tax status, not the entity itself.

⚠️IMPORTANT NOTE:

- Even if exempt, the Form NRW (Nonresident Real Estate Withholding) must still be filed by the withholding agent. [stewart.com].

- Sellers should consult a tax advisor well before closing to ensure compliance.

- Failure to comply may result in penalties and interest.

🔹 Withholding Rates

- Standard Rate: 4% of the gross sales price

- Alternative Rate: 5% of the estimated net gain

- Surtax: Additional 4% may apply if the gain exceeds the surtax threshold. [dlgclosing.com]

🔹 Special Cases Covered

- Installment sales

- Like-kind exchanges

- Corporate entities

- Estimated adjusted basis calculations

🔹 Special Cases Covered explained:

- Installment Sales

- If a real estate sale qualifies as an installment sale under Massachusetts law (M.G.L. c. 62, § 63), the entire gross sales price is still considered for withholding purposes.

- However, the withholding amount may be limited to the cash received at closing, not the full contract price.

- The Transferor’s Certification must disclose the installment nature of the transaction and the amount of cash received.

- Like-Kind Exchanges (IRC § 1031)

- If the transaction qualifies as a like-kind exchange under IRC § 1031, and the gain is deferred, withholding is not required on the deferred portion.

- The Transferor must certify:

- The amount of gain deferred.

- That they consent to Massachusetts jurisdiction for future tax collection when the gain is eventually recognized.

- If any gain is recognized (e.g., due to boot or partial cash received), withholding is required on that recognized portion.

- Corporate Entities

- Corporations with a continuing Massachusetts business presence may be exempt from withholding.

- To qualify:

- The corporation must have filed a Massachusetts tax return in the prior year.

- It must maintain a place of business in Massachusetts.

- It must not be selling all or substantially all of its Massachusetts assets (which would trigger other tax obligations under M.G.L. c. 62C, § 51).

- Estimated Adjusted Basis Calculations

- This is used when a seller elects the alternative withholding method based on estimated net gain rather than gross sales price.

- Estimated Adjusted Basis includes:

- The original purchase price (or fair market value at inheritance).

- Plus major improvements (if known).

- The Estimated Net Gain = Gross Sales Price − Estimated Adjusted Basis − Settlement Expenses.

- The seller must provide this calculation on the Transferor’s Certification to use the alternative method.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link